No matter what business you’re in, taking payments brings more regulations you must follow. For instance, companies that use recurring payment processing services need to maintain Regulation E compliance.

But how do you know when Regulation E applies to a transaction within your business? How can your payment processing software help?

Recurring EFT Payments and Regulation E

What is Regulation E? It is a rule within the Electronic Funds Transfer Act (EFTA). It covers who the EFTA applies to and when it must be taken into account.

Both fines and criminal liability can be consequences of failing to comply with Regulation E. It is best to understand your responsibilities as a business to avoid these penalties.

Who Must Comply?

Regulation E is mostly applicable to financial institutions. “However, there is also a somewhat "catch-all" provision for applicability of Regulation E to service providers other than financial institutions,” says financial services attorney Mike Etmund.

“If electronic funds transfer services are made available to consumers by a person other than a financial institution holding a consumer's account, the disclosures, protections, responsibilities and remedies shall be applicable.”

This means that any business that offers EFT payment options must follow the applicable sections of Regulation E.

REGULATION E AND RECURRING PAYMENT REQUIREMENTS

To protect consumers from recurring payments they do not consent to, companies must gain pre authorization before an EFT takes place.

The definition of a preauthorized electronic funds transfer is “one authorized by the consumer in advance of a transfer that will take place on a recurring basis, at substantially regular intervals, and will require no further action by the consumer to initiate the transfer.”

To comply with Regulation E, your company must:

- authenticate the consumer

- provide the consumer a copy of authorization (either through paper or electronic means)

- show evidence of your customer’s consent

PDCflow Software and Recurring EFT Payments

When setting up recurring payments, PDCflow offers built-in compliance features to keep your business safe without slowing down office processes.

- Meet Regulation E compliance and get payment schedules up and running faster. Send payment schedules and written authorization documents to consumers by email or text so they can review the schedule and provide signed consent fast.

- With PDCflow’s Flow Technology, businesses can choose to authenticate a consumer’s identity.

- Send payment plan details and payment reminders to consumers through email and SMS.

- Accept both ACH payments and credit/debit card payments in a recurring payment plan.

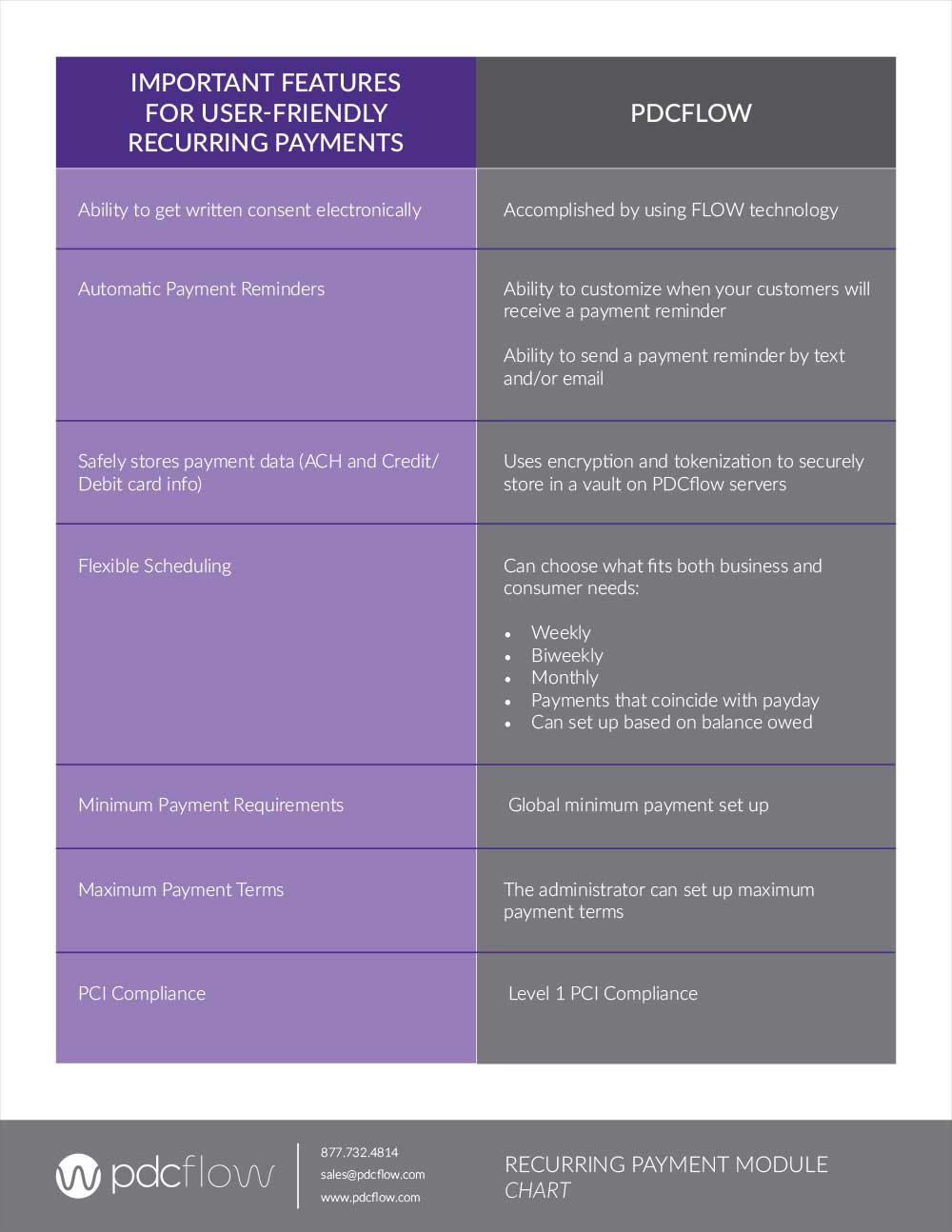

Recurring Payment Processing Software Checklist

PAYMENT GATEWAY SECURITY

- PCI compliance – your payment software should limit PCI compliance scope, whether agents work in the office or remotely.

- Chargeback prevention – look for reporting features that include proof of authorization, time/date stamp and other features that prove right-party authentication and can help you win chargebacks.

- Data tokenization and encryption – encryption is a common practice to keep data safe. Find a payment tool that also offers credit card and ACH bank account tokenization, decreases your risk, and protects consumers from fraud.

CUSTOMER EXPERIENCE

- Flexible payment schedules – people may need weekly or bi monthly payments to coincide with their paychecks. Your system should be able to accommodate their needs.

- Adjustable payment terms – you need to balance consumer needs with payment schedules that make sense. Adjust schedule lengths and minimum payment amounts so schedules don’t stretch on too long. Establish minimum payment amounts that are acceptable for your business needs.

- Automatic payment reminders – Along with compliance purposes, automatic payment reminders offer convenience. Sending a reminder helps you avoid running expired cards and reminds consumers to contact an agent if they can’t make their next payment. This reduces the likelihood of failed payments.

- Self-serve online recurring schedules – Offer more options to customers who wish to resolve their bills without the help of a representative. Payers can access self-created schedule options; Pay-in-4, or minimum payment amounts set up by your administrator.

Looking for payment software that makes payment management easy for your staff and customers? Schedule a demo today with a PDCflow payment expert.