Share this ArticleBy now, social media has become part of almost everyone’s daily life. Even for businesses, it’s expected to have a presence on at least one platform. However, using social media is tricky for those in Accounts Receivable. Does your agency know how to use social media? Do you understand why it’s so important? Why Use Social Media In …

What the Lavallee Case Teaches Debt Collectors About Using Email Communications

Whether or not you are in the collection space, the recent decision in Lavallee v. Med-1 Solutions should catch the attention of everyone in Accounts Receivable. If you haven’t already read about the case, Joann Needleman, Practice Leader and Member of Clark Hill PLC, recently discussed What Lavallee means for the CFPB’s proposed rule and Electronic Communications. “Med-1, as debt …

First Consumer Contact: Creating a Positive Customer Experience in Debt Collection

Debt collectors face numerous challenges when trying to resolve accounts. For many agencies, call blocking has begun to decrease right party contacts. Once a consumer is on the phone, you then need to overcome stalls or objections to find out why their debt has not been paid. These are just a few of the reasons a successful conversation on the …

A Closer Look: Validation End Date, Email and Digital Communications

The comment period for the CFPB’s Notice of Proposed Rulemaking (NPR) is closing soon. Now is the time for debt collection industry professionals to take action. The only way to let the Bureau know what collectors are excited about (and what areas need more consideration) is to file comments before time is up. Many debt collectors are looking to industry …

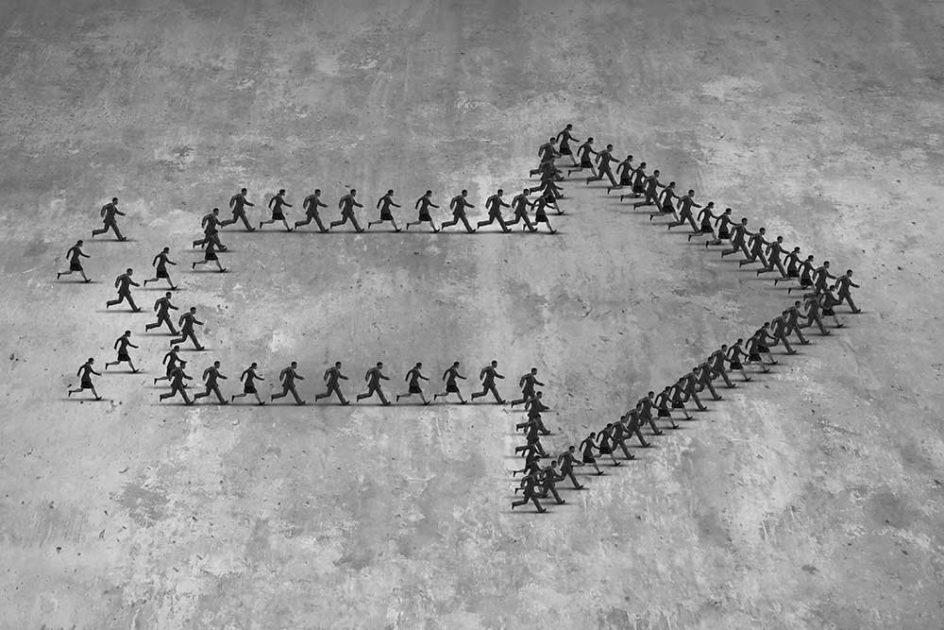

How to Build Your Brand as a Debt Collection Agency

The strategies and payoffs of marketing are clear-cut for B2C operations, but how do you build your brand if your industry is more nuanced? When you answer to your clients but interact daily with their consumers, what messages should you send? Which audience should you appeal to? Answering these questions will help you form your brand identity, putting you on …

What You Should Know About Submitting a Comment to the CFPB’s Notice of Proposed Rule for Debt Collection: A Step-by-Step Guide

Share this ArticleReprinted from Clark Hill with permission from Joann Needleman The Consumer Financial Protection Bureau’s (CFPB or Bureau) Notice of Proposed Rule (NPR) is a dense 500-page document. In the NPR, the CFPB puts forth numerous proposals which seek to clarify numerous debt collection processes that span from communicating with consumers to providing a new validation form. Many agencies …

Debt Collection and Consumer Advocacy Under the New Proposed Rule

Unclear, outdated guidelines and contradictory court rulings make debt collection compliance hard. That’s why so many industry professionals have been eagerly reading the CFPB’s new proposed debt collection rule. Clarity on expected procedures and how to use updated technology are giving collectors hope for a more direct way to fully comply. However, it became apparent during the CFPB Debt Collection …

CFPB Proposed Debt Collection Rules Release: First Thoughts from Industry Professionals

Share this ArticleJust one day after the Consumer Financial Protection Bureau (CFPB) Debt Collection Town Hall, and two days after the Bureau released its proposed new rules, Accountsrecovery.net hosted a panel of trusted ARM industry professionals to discuss first impressions of the CFPB proposed debt collection rules, and where we go from here. Rozanne Andersen, Vice President and Chief Compliance …

Credit and Collection Lawyers Discuss Upcoming Debt Collection Rule Proposal

Share this ArticleThe highly anticipated Consumer Financial Protection Bureau (CFPB) Debt Collection Town Hall will be taking place Wednesday, May 8, in Philadelphia. It is expected that this event is where the Bureau will release new proposed rules for debt collection. In preparation for the Town Hall, AccountsRecovery.net held a webinar on the topic. Joann Needleman, Mike Frost, Scott E. …

CFPB Proposed Rules: Why Collection Industry Input is Crucial

Kathleen Kraninger, director of the Consumer Financial Protection Bureau (CFPB), recently spent months on a “listening tour” to get an inside look at the credit and collection industry. Based on her findings, the CFPB has created proposed rules intended to clarify regulations and address advances in technology that have altered the industry landscape in recent years. There is no …

Thriving in Third Party: An Interview with Joann Needleman

Share this ArticlePDCflow is proud to support the credit and collection professionals who work hard to improve the industry. From regional leaders, mentors and new agency owners to industry educators, we strive to highlight the individuals who make this community great. This week’s spotlight interview is an in-depth conversation with attorney and industry advocate Joann Needleman, Practice Leader and Member …

Expert Advice: Shopping for Accounts Receivable Software

Accounts receivable software automation can save your staff hours on routine tasks. But, purchasing the right software is hard. There are dozens of options to consider when shopping for accounts receivable software. Where do you start the decision-making process? PDCflow is here to help. We spoke to our Product Management Analyst and a few ARM software partners to gain insight. …