Whether or not you are in the collection space, the recent decision in Lavallee v. Med-1 Solutions should catch the attention of everyone in Accounts Receivable.

If you haven’t already read about the case, Joann Needleman, Practice Leader and Member of Clark Hill PLC, recently discussed What Lavallee means for the CFPB’s proposed rule and Electronic Communications.

“Med-1, as debt collector, attempted to collect two medical bills owed by Lavallee. On two separate occasions, Med-1 sent emails to Lavallee about her debts. The email messages stated that “Med-1 Solutions has sent you a secure message” and featured an embedded hyperlink inviting Lavallee to click onto the “View Secure Package” button which would have navigated her to additional screens.

Ultimately, Lavellee would have reached a screen with a PDF where she would have been able to view the validations notices as required by §1692g of the FDCPA. Lavellee never clicked onto the hyperlink and never opened the PDF files that contained the validation notices.

Several months later, Lavellee called Med-1 regarding an unrelated matter and learned for the first time about the debts Med-1 previously attempted to collect. Med-1 never followed up with another set of validation notices after that phone call. Lavellee sued claiming that she never received the required validation notice.

The Circuit Court framed the issue in the case as follows: whether the first communication was the emails sent to Lavallee or the phone call from Lavallee several months later. Med-1 argued that the first communication was the emails. The court disagreed because the emails did not “convey information regarding the debt” or imply the existence of a debt. The Court found at a minimum, the emails were a “digital pathway to access required information.”Joann Needleman - Clark Hill Law

Lavallee Case Key Considerations

In reading the case, the articles written about it and the Consumer Finance Protection Bureau’s (CFPB’s) amicus brief on the case, two issues are outstanding.

1) The consumer never opened the email (which Med-1 didn’t know)

2) The link only provided a digital pathway with six (6) additional steps to access the information the consumer needed.

The two issues that the court points out are valid. Med-1 should have known that the consumer didn’t open the original message, making their telephone call the first communication. This is extremely important given the fact that no validation notice was sent following the phone call. Assuming that the information had already been received and reviewed at that point was negligent on their part.

How PDCflow Can Help

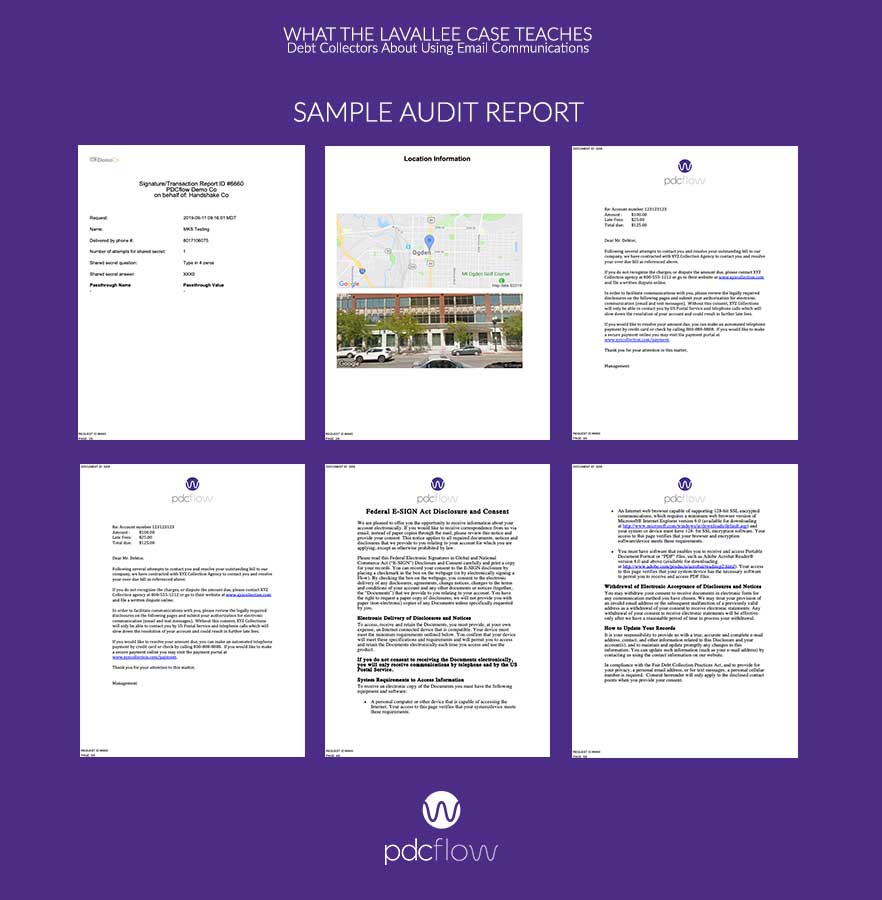

In order to prevent this type of situation from occurring with PDCflow’s clients, PDCflow’s software provides an audit trail and reporting for the electronic delivery of FLOWS, which can be delivered via email or text.

If the consumer doesn’t access the message, doesn’t view the information or even clicks “Reject” when they do view the information, those activities – or lack of them – will be in the reporting and actionable.

There should never be a situation where clients don’t know whether or not the consumer saw the information and they would be able to prove it in court.

The procedure for the consumer to access their information is much more direct in a FLOW.

The initial message can be customized to include information such as the mini-miranda and contains a link, which after consumer authentication, can display the Validation Information.

Two-factor authentication is a best practice for both security and privacy, so it would be hard for a court to refute that verification of identity is a necessary step in accessing legally required private information.

Once the consumer enters their PIN, they immediately see the information sent. That could be the Validation Notice, account details or payment plans, but they would need to click Accept or Reject to move beyond that page for signature, payment or other details. Two steps to access their information, not six. And one of those steps proves right party contact.

While the Notice of Proposed Rulemaking doesn’t explicitly address using the Validation Information in the first communication, the hope is that the CFPB will clarify this issue and provide a safe harbor to the industry.

Meanwhile, whether you’re in first party or third party collections, the use of a FLOW by email or text message can be done in a legal and compliant manner right now.

If you’d like to learn more about PDCflow’s FLOW solution, sign up for a short demo: