Blog

Get actionable insights, tactics and expert advice to improve the payment experience and create a better cash flow.

Featured

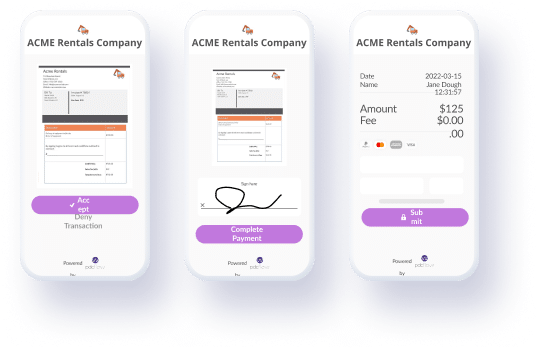

Electronic Signatures

Streamline Operations with Document Workflow Management

Digital communications are a huge part of business and customers expect you to use modern channels like email and text — even when it comes to sending and signing paperwork, or taking a payment. Your company’s communication and esignature software should come with flexible workflow management tools that do everything you need them to, all in one place. This way, ...

Featured

-

Office Operations

Organizational Management: Tools for Better Productivity

-

PDCflow News

Send Multiple Documents in One Request with PDCflow

-

PDCflow News

Automated Reminders for Higher Open Rates and Engagement

-

PDCflow News

Fully Branded Contract, eSignature, and Payment Requests

-

Electronic Signatures

Guide to Contract Elements for Entrepreneurs

About PDCflow

See all blog postsDigital Strategies and Tools

See all blog postsLoad More

Let us be your guide

Get answers to specific questions or to get a custom quote. Find out why PDCflow is the right choice for your organization’s digital workflow needs.

Subscribe to our newsletter

Get actionable insights, tactics and expert advice to improve the contract and payment experience and create a better cash flow.