The California Association of Collectors (CAC) conference and expo held each year in October features some of the best leaders in the credit and collection industry. Many of the sessions center on best practices for successful agencies, but some sessions provide unique advice which can be applied to all aspects of personal, professional and team leadership communication, no matter what …

Hiring Process Steps to Build a Strong Debt Collection Team

This post was originally written by Mary Shores, agency owner of Midstate Collection Solutions, and was recently updated. It’s no secret that the hiring process has become a challenge in most industries, and the debt collection industry is no exception. We spend time writing job descriptions and interviewing, only for our candidates to change career paths. Or, we choose a …

How To Create a Credit Policy and Collection Procedure

The blueprint most businesses use to collect on accounts receivable is called a credit and collection policy. The guidelines are typically broken into two sections: a credit policy and a past-due collection procedure. The framework can be as detailed or as broad as is necessary for your office. Providing this direction to your employees is essential. Unfortunately, many businesses don’t …

Accounts Receivable Collections Best Practices: Handling Late Payment Excuses

Every employee will encounter late payment excuses in accounts receivable collections. Greg Ruffino, a successful coach and trainer in the accounts receivable industry, is well-versed in the difficulties a consumer’s payment stalls and objections can cause. Ruffino shared his knowledge on the subject, including common excuses for late payments consumers give and effective debt collection techniques to overcome them.Payment Excuses …

A Guide to Lawyer Trust vs Operating Accounts

As a law practice, it’s important to follow rules for how to handle a client’s money. This means keeping funds separate through different lawyer trust accounts and operating accounts. Using multiple accounts to manage these finances can be tricky. It’s essential to have strict financial management practices and payment software that can handle multiple lawyer trust and operating accounts.What is …

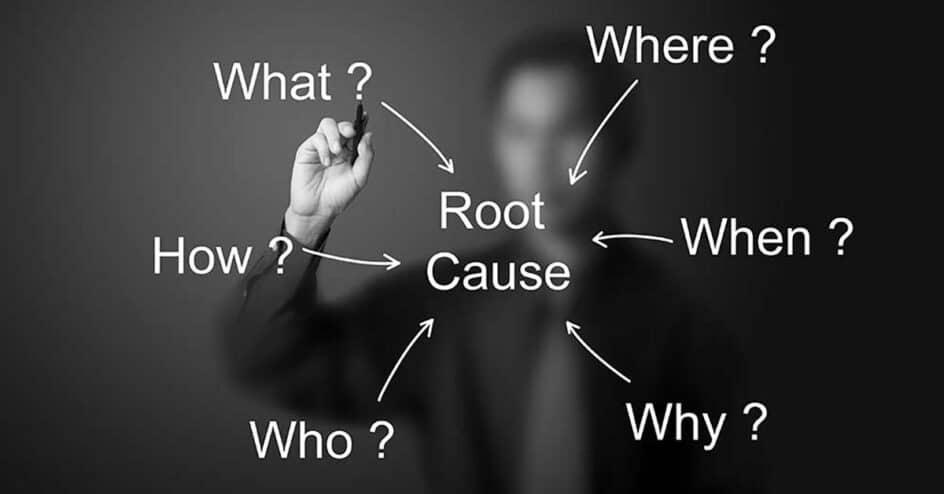

Use Root Cause Analysis Methods to Improve Policies and Procedures

Courtney Reynaud, President and CEO of Creditors Bureau USA, has found success in her agency with careful attention to policies, procedures, and work instructions. But, she didn’t always have such a strong compliance management system. Before her office focused on these practices, she noticed blame would often be placed on a single employee or a client. Reynaud explained that blaming …

Organize a Successful Working Group for Your Business

For self-sufficient professionals, it can be hard to share workloads. This mindset can sometimes be positive, but more often, this thinking leads to forgotten tasks, overlooked details, and staff burnout. Working groups are a more efficient way to solve difficult problems or finish big projects.Working Group DefinitionA committee or group of people appointed to study and report on a particular …

Cash Flow Positive: The Ultimate Compass for Your Small Business

In the vast ocean of business, being cash flow positive is your ultimate compass. Having cash to spend gives you more options–to expand and grow, to invest back into the organization or to share with stakeholders. Cash flow statements, profit and loss statements and other financial management reports steer these financial decisions your company makes. Explore what cash flow reports …

Profit and Loss Statements for Business Planning and Growth

Businesses want to make money. But how do you know if sales are good enough to keep your company profitable? There are many different financial reports organizations use to track performance. One of the most common–the profit and loss statement–lets companies: Monitor how the organization is performing and better understand profitability Assess expenses and profit trends Plan for future growth …

Small Business Financial Management Terms and Tips

Small business financial management helps business owners, operators and managers know where money is being spent and how much profit is coming in. Without a background in accounting or bookkeeping, it can be hard to know the best way to manage small business finances – or even to understand the common terms, reports and tactics used. This glossary will help …

4 Pillars of Empathetic Communication in Healthcare Finance

Since the beginning of the COVID-19 pandemic, “empathy” and “compassion” have been buzzwords in almost every industry. People are craving the human connection and understanding that comes with empathy, which is why now more than ever, understanding compassionate, empathetic communication is extremely important. For organizations that collect healthcare payments, having empathetic communication skills should be part of your company policies. …

Creating Credit Terms for Customers

Companies who sell high dollar products, or offer professional services, usually ask for payment after work is done or goods are delivered. Establishing clear credit terms helps customers know what to expect during billing and teaches staff proper procedure when collecting on both B2C and B2B payments.Definition of Credit TermsCredit terms can be defined as the guidelines your company creates …