In the vast ocean of business, being cash flow positive is your ultimate compass. Having cash to spend gives you more options–to expand and grow, to invest back into the organization or to share with stakeholders.

Cash flow statements, profit and loss statements and other financial management reports steer these financial decisions your company makes.

Explore what cash flow reports can tell you about your business and how they can set you on the right course for the future, starting with the basics.

What Does Cash Flow Positive Mean?

Cash flow positive is when your company has more cash coming in than going out. This should be every organization's basic goal. Cash flow can change depending on many factors, like the stage of your business, temporary spending projects or dips in profitability.

Your cash flow statement is important because it details how much actual money is available at a given time.

A cash flow statement is typically managed through cash-based accounting. This means, it records the actual amounts that are spent and earned within a company.

This is unlike other reports, like the profit and loss statement, that may use accrual-based accounting that records income and expenses, even if the transactions for them have not cleared.

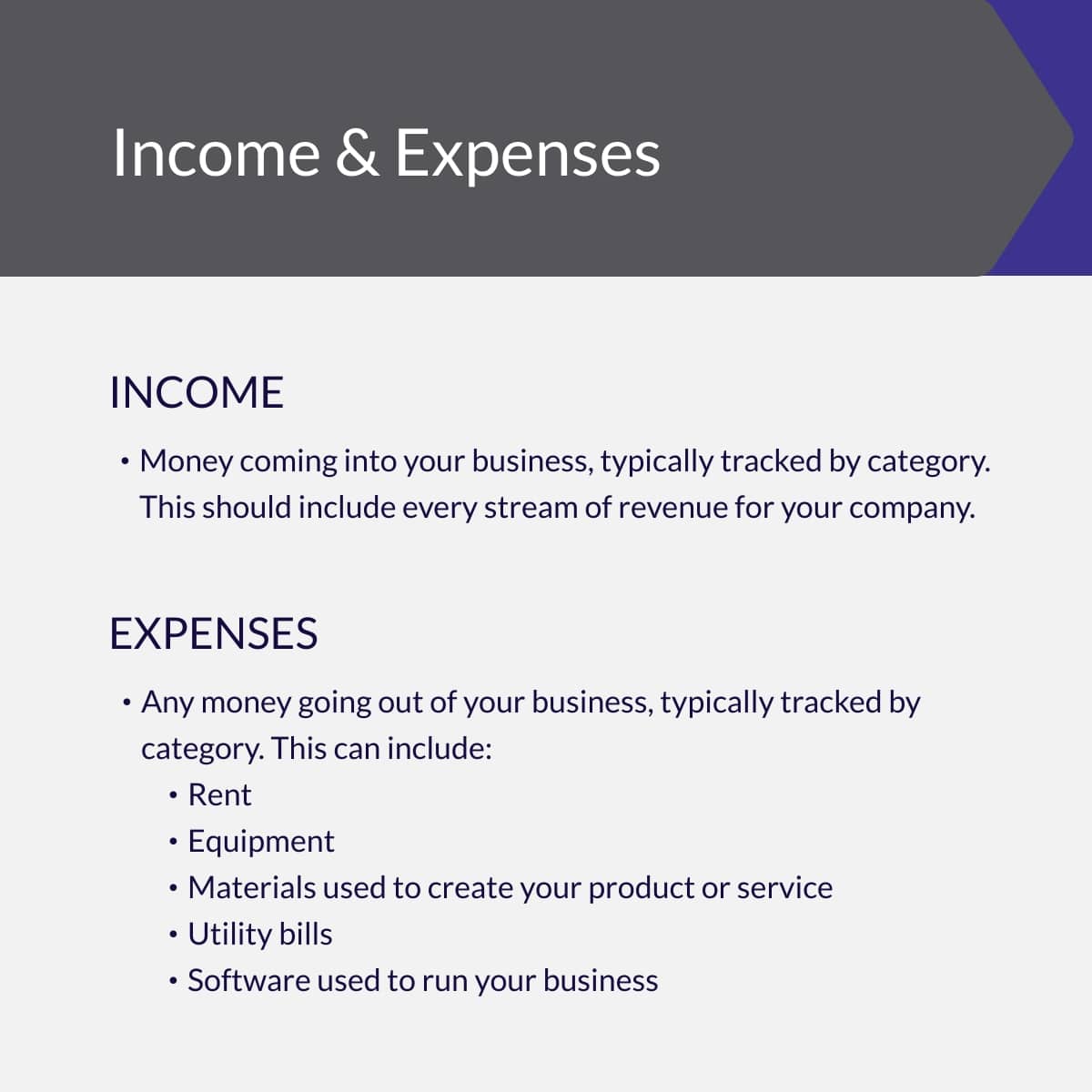

Cash Inflow Vs Outflow

Positive cash flow helps companies understand the funds they have available. Part of that understanding comes from measuring both cash inflow and outflow.

Knowing all of your company’s sources of revenue and monitoring expenses can create a fuller picture of your financial health.

Cash inflow definition

Cash inflow is the money coming into your company. For cash inflow, it’s important to measure revenue from every source, including sales, loans, investments or any other sources of incoming funds.

Cash flow statements measure inflow through:

- cash flow from operating activities

- cash flow from investing activities

- cash flow from financing activities

Cash outflow definition

Cash outflow measures the amount of cash leaving your business. Common sources of cash outflow include things like payroll, payments to suppliers and other operating costs.

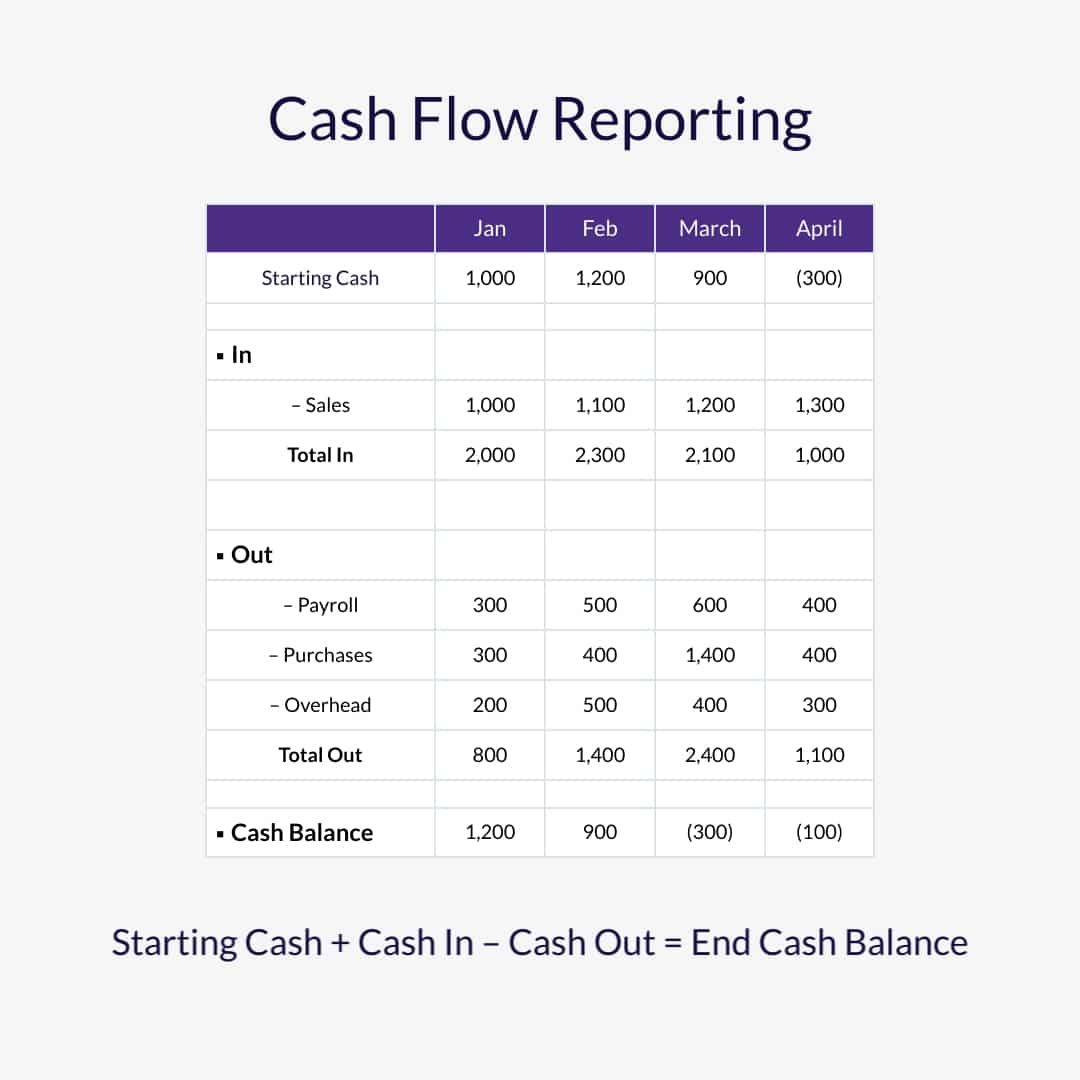

How Cash Flow Statements are Calculated

To measure your company’s positive cash flow:

- Record what is in your company’s bank account

- Record the cash inflows to your business (sales, investments)

- Record the cash outflows (payroll, purchases, overhead, capital expenses)

- Add starting cash to cash inflows

- Subtract cash outflows from that number to find your ending cash balance

Why is Being Cash Flow Positive Important?

Adding new expenses to your company isn’t always a bad thing. Being cash flow positive grows business by allowing you to spend money on things that boost future sales.

Positive cash flow can give you the flexibility to increase marketing budgets, hire employees to run things more smoothly, or upgrade equipment that makes tasks faster and more efficient.

If you don’t have that cash flow to spend, your company will struggle to grow.

Keep in mind–companies that invoice or offer financing terms may look like they are operating at a profit, but could have no money in the bank.

When this happens, it is usually because a high volume of customers haven’t paid for work that has already been done.

The Impacts of Unpaid Work on Cash Flow

In order to make profits and keep cash flow positive, your company needs to get paid for the work you do. Most companies experience nonpayment from customers to some degree. It’s important to keep the number of unpaid invoices as low as possible.

Organizations that don’t manage overdue invoices will experience:

- Wasted time providing work for non-paying customers

- Wasted resources used to serve customers who don’t pay

- Lower profits

- Limited or negative cash flow

- Inhibited growth

Tactics for Reducing Late Invoices

Fortunately, there are many tactics companies can use to encourage faster payments. By making workflows faster and easier to get through, automating processes and communicating clearly about payment terms, companies can cut down on late payments.

Here are some specific ways to reduce the number of late or unpaid invoices in your organization:

Payment plans

There are many reasons a customer may want to pay their bill in installments. Usually if a bill for service is large, people won’t have the money to pay the entire invoice up front. If you let customers create recurring payment schedules, they are more likely to pay.

Easy payment channels

Taking more payments can sometimes be as simple as making it easier to pay. If a customer doesn’t have a lot of time to spend on paying bills, make your self-serve channels fast, easy and intuitive to use and you will naturally bring in more money.

Good customer service

Customers are more likely to complete a transaction with you if they are happy with their service. It’s important to provide a consistent level of service from sales all the way through to payment.

Otherwise, customers will dispute what they owe, ask for refunds (either directly or through their bank) or simply refuse to pay.

Clear payment terms/invoicing

Outlining how your payments work is a simple way to set expectations with customers.

If they know what the terms of the agreement are, when payment is due and the options they have to pay–clear from the beginning of a sale–they are more likely to stick around and pay what they owe.

Good inter-departmental communication

Sometimes invoices go unpaid due to miscommunications. When invoicing customers–especially for B2B payments–you may find that something as small as formatting can cause failed company payments.

Your departments all need to work together, take notes and remain on the same page to reduce/eliminate late payments.

Running payments automatically

Any time you can automate transactions, you will eliminate a late payment. Capture and store customer payment data up front at the time an agreement is made.

That way, once the invoice due date arrives, you can automatically run the transaction without reaching back out to a customer or relying on them to initiate a transaction.

PDCflow for Positive Cash Flow

PDCflow supports customers in many aspects, all the way through the financial management process. Our software helps companies reach customers where they are, take payments faster and monitor transaction success through robust reporting.

Payment communications

Customers need fast, simple ways to interact with your company. PDCflow’s Flow Technology uses email and text messages to send customers information relevant to them in the channels they prefer.

With Flow, companies can send payment reminders, bills, payment requests and more to an email address or mobile number. This makes it fast and easy for people to sign work agreements or pay from anywhere.

These preferred communication channels increase customer satisfaction and make people more likely to stay engaged with company communications.

Taking payments

PDCflow payments allow businesses to take credit, debit and HSA card payments and ACH payments through a variety of payment channels.

- Send an email or SMS smart request for payment

- Take payments through a branded online payment portal

- Print a QR code payment link on a paper statement

- Take agent-assisted payments over the phone without having to hear, see, type or store the payment details within your own systems

Payment reporting

To compile your financial reports, you need reliable data. For cash flow statements, you need accurate transaction reports to know which payments have been completed and which are still outstanding.

PDCflow’s Insights Reports give your company clear data that shows which transactions have been successfully completed, which are still pending, and those that have failed. Get the information you need to monitor and record your company’s cash inflow from sales.

Automated billing

PDCflow’s invoicing tool, Flow Billing, can eliminate late payments, making statements more accurate and increasing cash flow. Flow Billing works by gathering, verifying, and storing payment details from customers at the time they are added into the system.

After the customer enters their data, PDCflow’s software tokenizes, encrypts and securely stores the information. When the invoice date arrives, the payment is automatically processed.

This system makes it faster and easier to keep track of payment due dates with a small crew, eliminates the need to follow up about unpaid invoices and makes it easier to monitor payments for cash flow statements and other financial reports.

For more information on PDCflow’s payment, communication and invoicing tools, request a call from a PDCflow payment expert today.