The blueprint most businesses use to collect on accounts receivable is called a credit and collection policy.

The guidelines are typically broken into two sections: a credit policy and a past-due collection procedure. The framework can be as detailed or as broad as is necessary for your office.

Providing this direction to your employees is essential. Unfortunately, many businesses don’t use a formal credit policy manual to outline the official positions of the company, but having one is crucial.

Credit policies and procedures offer clarity to staff by explaining the roles and responsibilities of each team member when extending credit and pursuing unpaid bills.

These guidelines can also prepare customers for what to expect during the customer journey from sale to payment.

What Is a Credit Policy And Procedure Document?

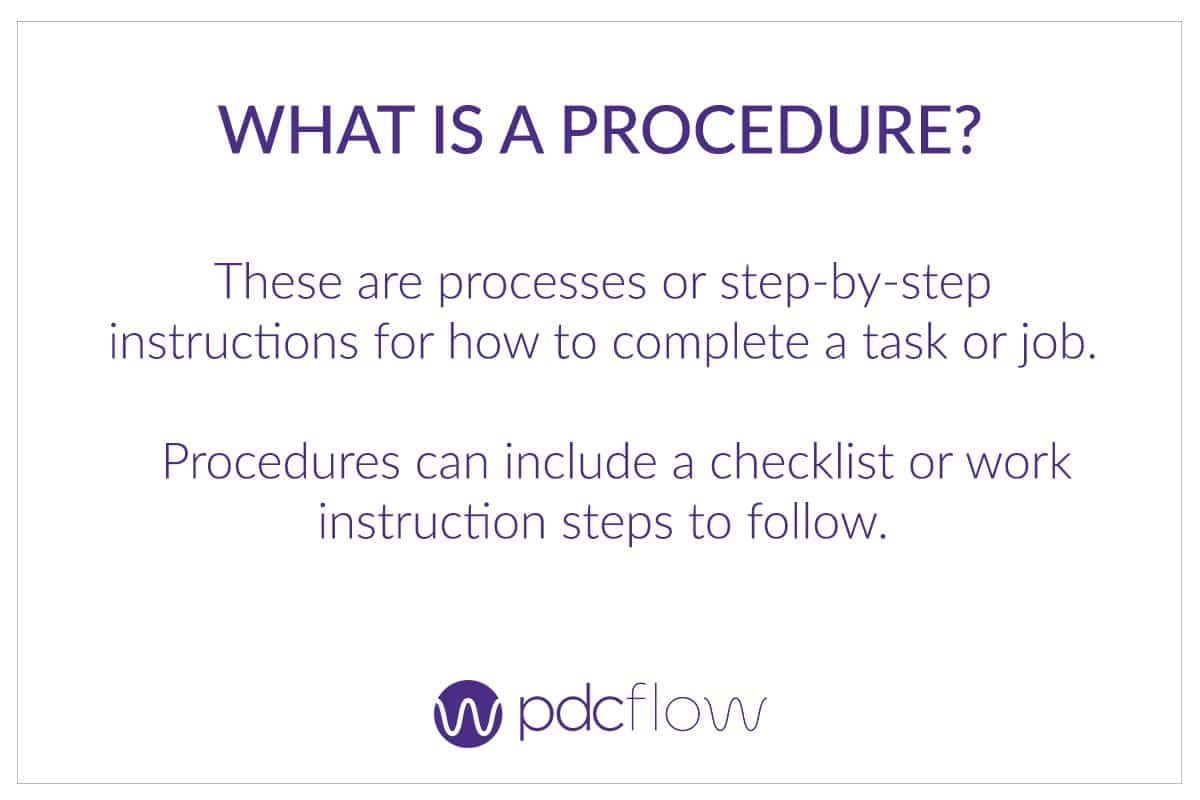

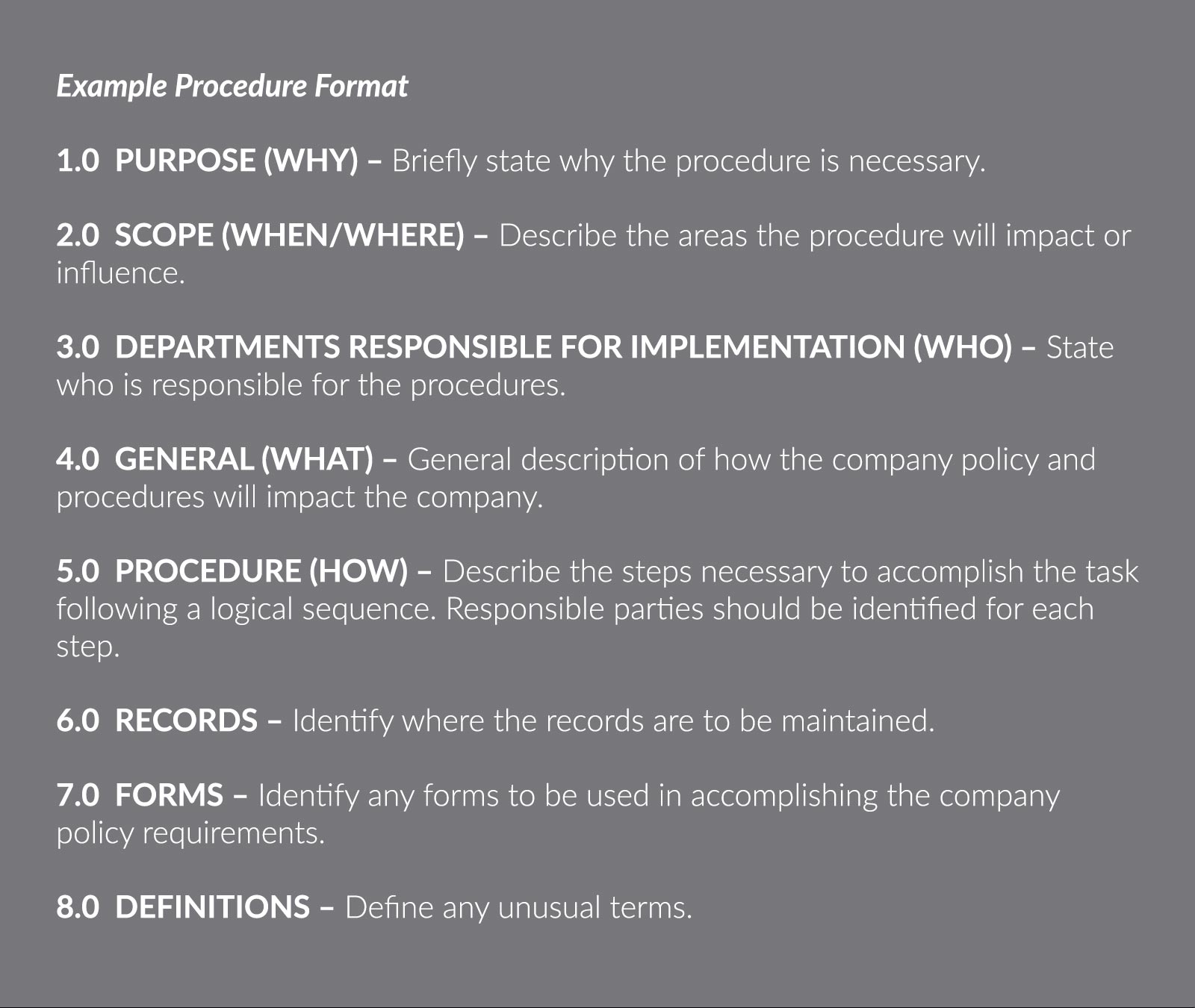

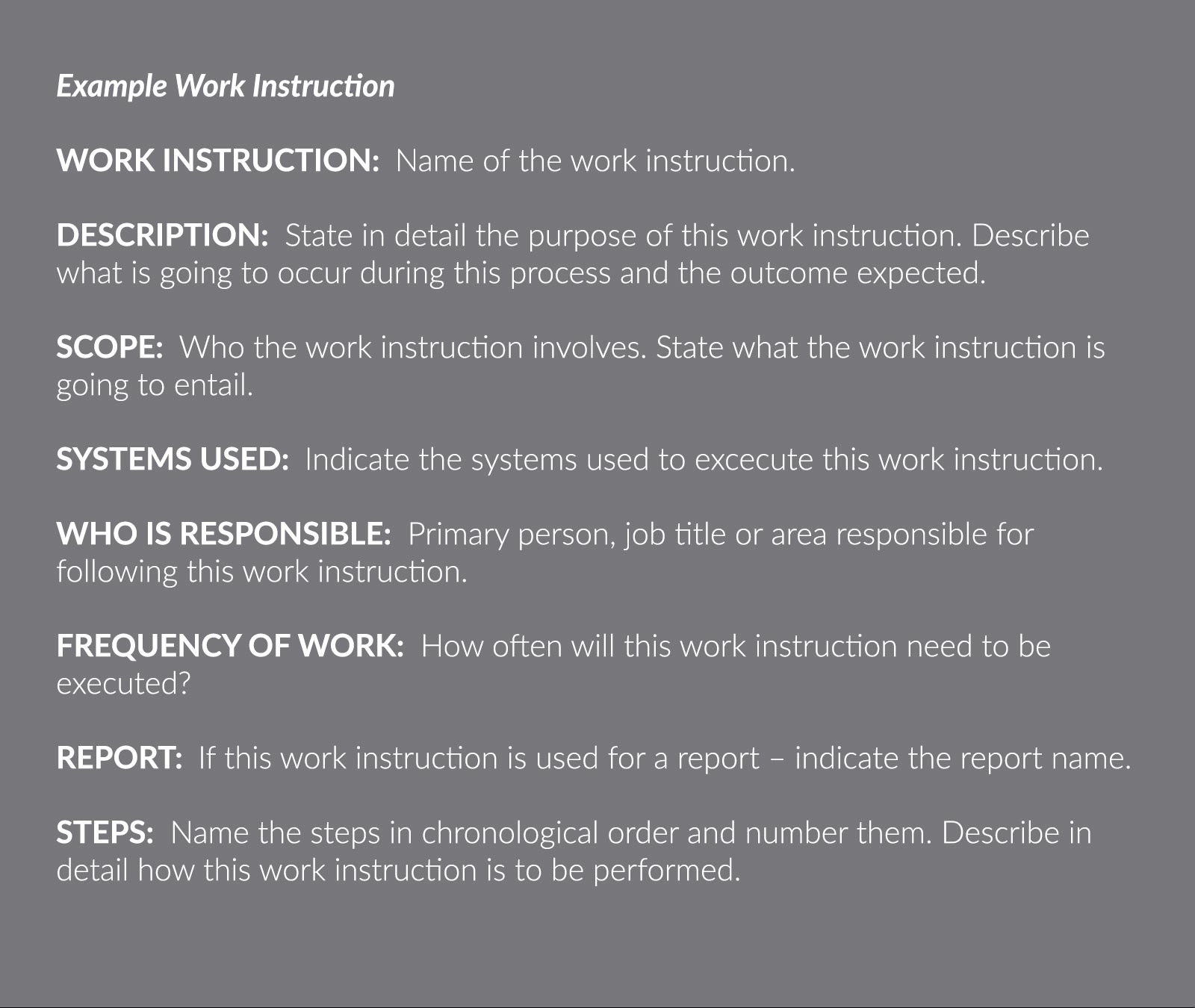

Credit policies and procedures intended for accounts receivable management are no different than those for the rest of your company. These guidelines should be part of your company's larger internal system.

Your company’s policy and procedure guide should cover all areas of your business and provide a blueprint for how the organization is expected to operate.

Employees should have access to relevant sections at all times. This availability will cut down on the amount of time managers spend rehashing business credit policies. It will also empower employees to become more self-sufficient and educated on your standard operating procedures (SOPs).

Components Of a Credit Policy And Past Due Collection Procedure

Credit

Any company that offers goods and services without immediate payment is a creditor. This includes healthcare providers and law offices, among others. Your credit policy should define your guidelines for extending credit to consumers, answering these questions:

- To whom does your company extend credit?

- What are the criteria for extending credit to customers?

- Are there any exclusions to this policy?

- For example, do you only serve certain states or regions?

- Within your organization, who is authorized to grant credit to customers?

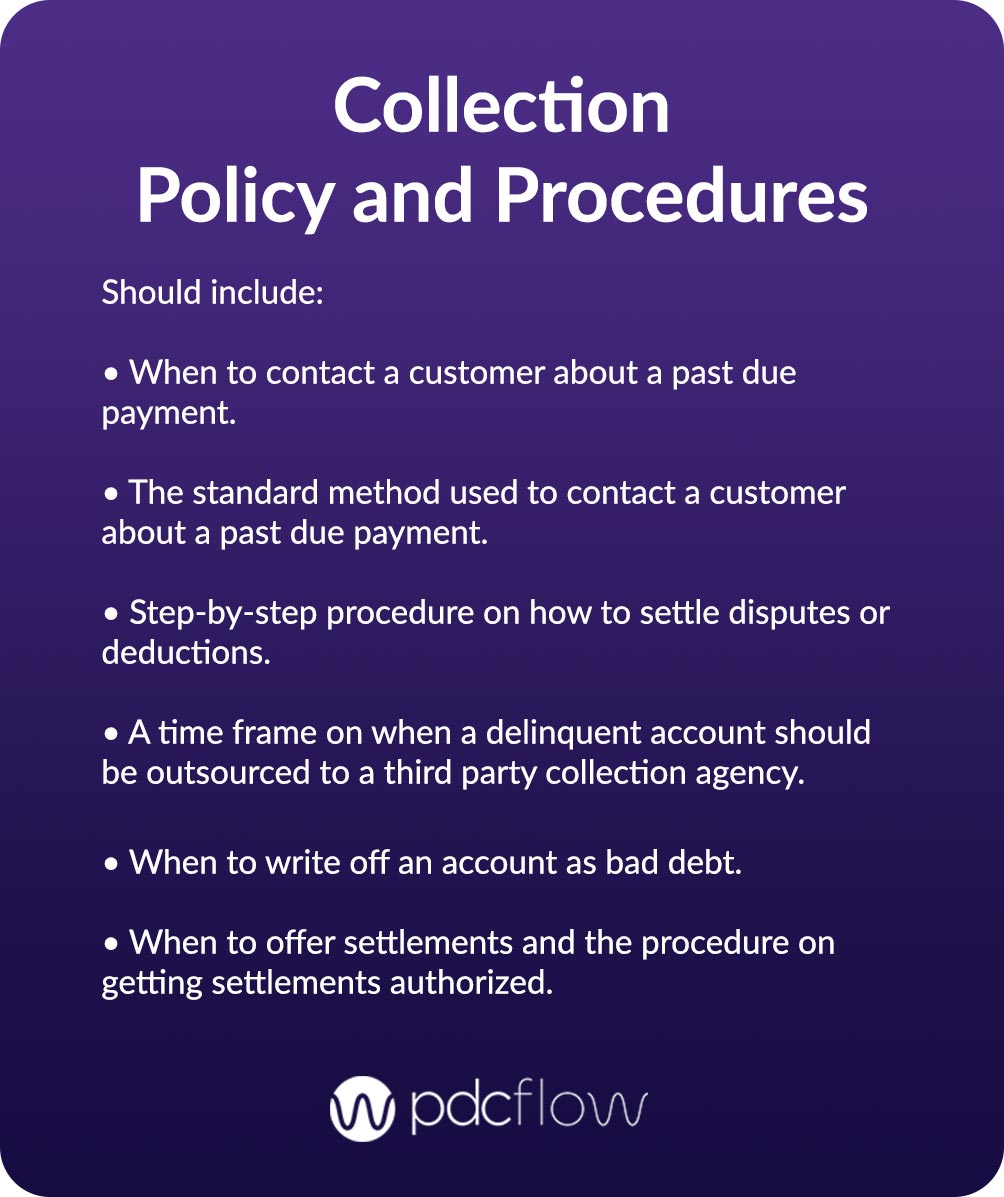

Collection

The other half of this system should center on billing, collecting payments, and past-due collection procedures. For this part of the document, you may want to include:

- The different positions within the AR billing department, and the responsibilities of each position.

- Terms and conditions to be communicated to the consumer, such as: when to expect a bill, how long the consumer has to pay, or the collection process if a consumer does not pay on time.

- If your company outsources collection activity to an Extended Business Office for early intervention or a third-party debt collection agency for further collection after 90 days past due.

What Can a Credit Policy And Past Due Collection Accomplish?

Staff Impact

Your employees are the face of your company. They are the ones who interact with consumers and carry out the actions that reflect your business. Especially during the collection of late payments, it’s important your staff builds trust and maintains your brand image. An established policy also helps:

- Protect your organization from possible missteps caused by an employee guessing what is expected of them.

- Streamlines call center training, education refreshers, and policy updates, as everyone should have access to the same information at all times.

- Provides a framework for company culture by establishing official expectations.

Customer Relations Impact

Customers are the reason you stay in business. A credit policy and past due collection procedure should make the billing, invoicing and payment process as easy as possible for them. If this is the case, more customers will make their payments on time, increasing your customer service quality and bottom line.

A strong, well-communicated policy and procedure document will also ensure your office recovers more late payments. Doing this work upfront will yield big results later by reducing (or even eliminating) the need to use a third party for collection.

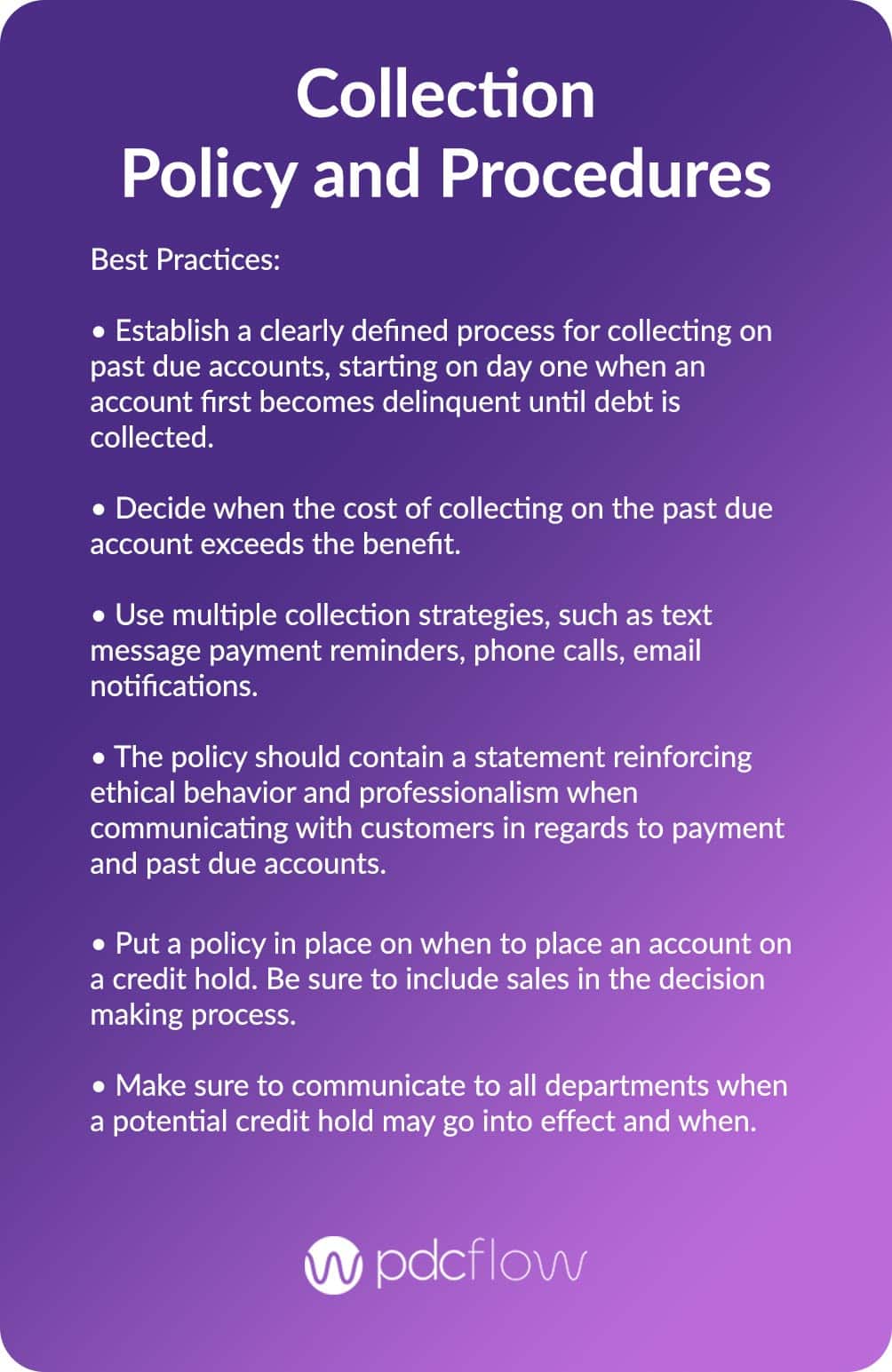

Remember, to help your accounts receivable team successfully connect and engage with customers, provide a positive experience and run a healthy business you need to stay informed on the latest trends and industry best practices.

Subscribe for weekly updates or to our monthly newsletter for actionable insights, tactics and expert advice to improve the payment experience and create a better cash flow. delivered to your inbox.