With so many self-serve and digital payment options available, storing credit card information is an important consideration for businesses.

Is your organization storing credit card information safely? Do you know the requirements you need to follow? Learn about risks, requirements and best practices of storing customer credit card information.

Why is Storing Credit Card Information a Must for Digital Payments?

There are many types of transactions that rely on storing credit card information to function. Here are a few examples:

- Recurring payments - for automated recurring payments, you need software capable of storing credit card information, so transactions can automatically be processed.

- Repeat customers - for companies with repeat customers, it can be frustrating to provide your credit card number every time you make a purchase.

- Invoicing for future payments - many companies do work or provide goods before payment is due. This creates a greater risk that customers will pay late–or not at all. Companies can store credit card information when customers agree to your terms of service, then automatically run transactions the date an invoice is due.

Risks of Storing Credit Card Information

Storing credit card information is common, convenient and creates a better customer experience. But digital payment options require secure storage and careful handling to keep payment details safe. When keeping a credit card on file, you must worry about:

Fraud

Fraud is a common risk during digital transactions. People commit fraud in a number of ways, like using a card that doesn’t belong to them or purposefully using a bad credit card number.

Depending on your software and how your payment pages are configured, you can fight fraud before a payment is declined or returned.

Storage Security Concerns

Taking credit card payments and storing credit card information are essential parts of a modern digital payment strategy. This means your company must also accept and prepare for the internal and external threats that come with improper or mishandled data.

- External: if you don’t encrypt and tokenize payment data, data breaches and poor handling can expose credit card numbers to the world. You need to use a secure, reliable storage method to prevent accidental (or malicious) exposure.

- Internal: cardholder data can be at risk at the hands of employees, too. Although a rare occurrence, employees with access to sensitive data can also pose a risk to private customer information.

PCI Compliance Management

The Payment Card Industry Standards Security Council (PCI SSC) is a group made up of professionals from the payment card industry. They recognize the importance of keeping customer information confidential.

In an effort to keep customers safe during payments, this group created PCI compliance rules that every merchant that accepts cards must follow. If your company wishes to store credit card information in-house, you need to pay close attention to PCI compliance guidelines.

Most merchants choose to use a level 1 PCI compliant payment vendor who handles and stores card data on behalf of the company. This makes it simpler to comply and keep details safe.

PCI Compliance Requirements

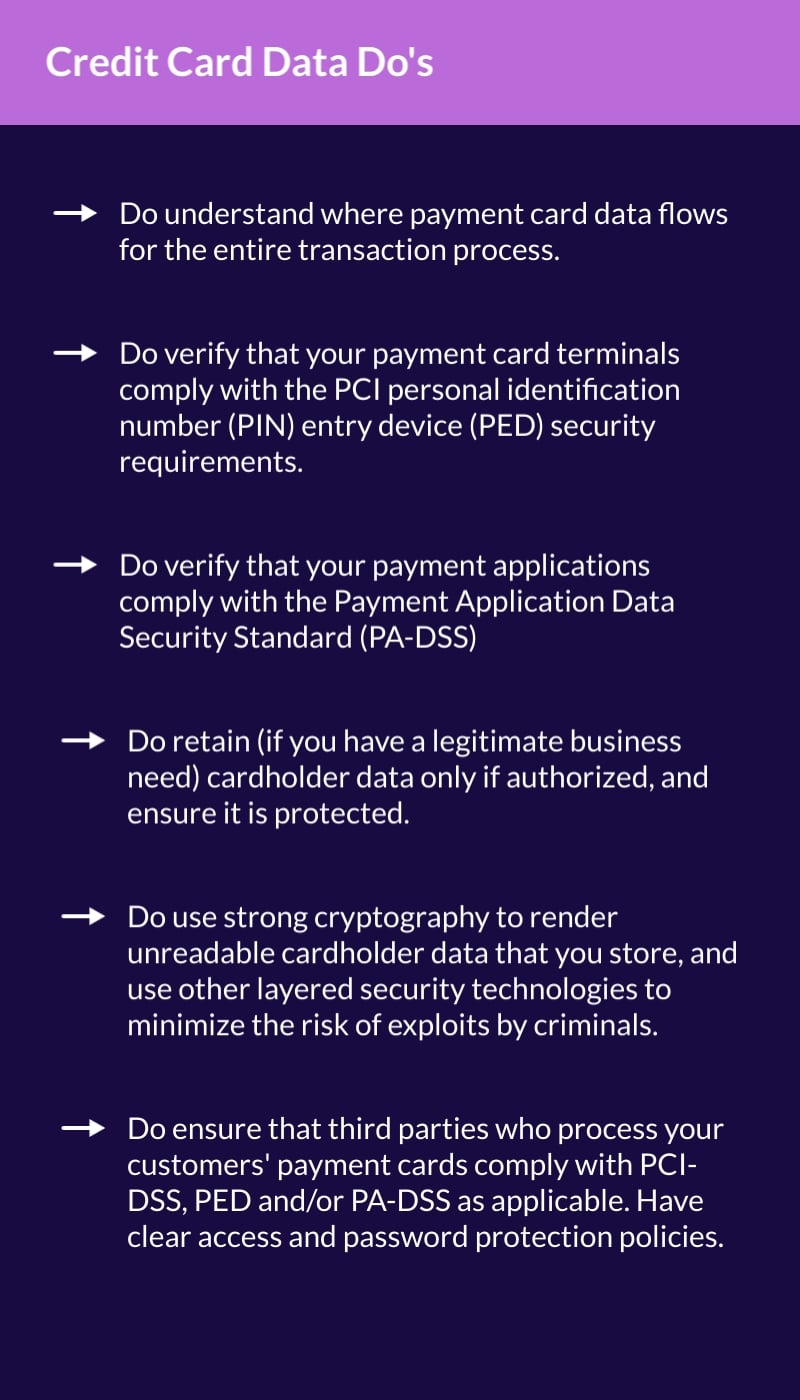

No matter where your company plans to store credit card information, you should understand the basic PCI compliance rules, to make sure you and your vendors are doing all you can.

Basic PCI requirements state that wherever card information is being stored (whether with you, or through a vendor) the numbers need to be unreadable.

This can be done through things like truncating account numbers, using tokens (random placeholder numbers to represent each card number) and encrypting important information.

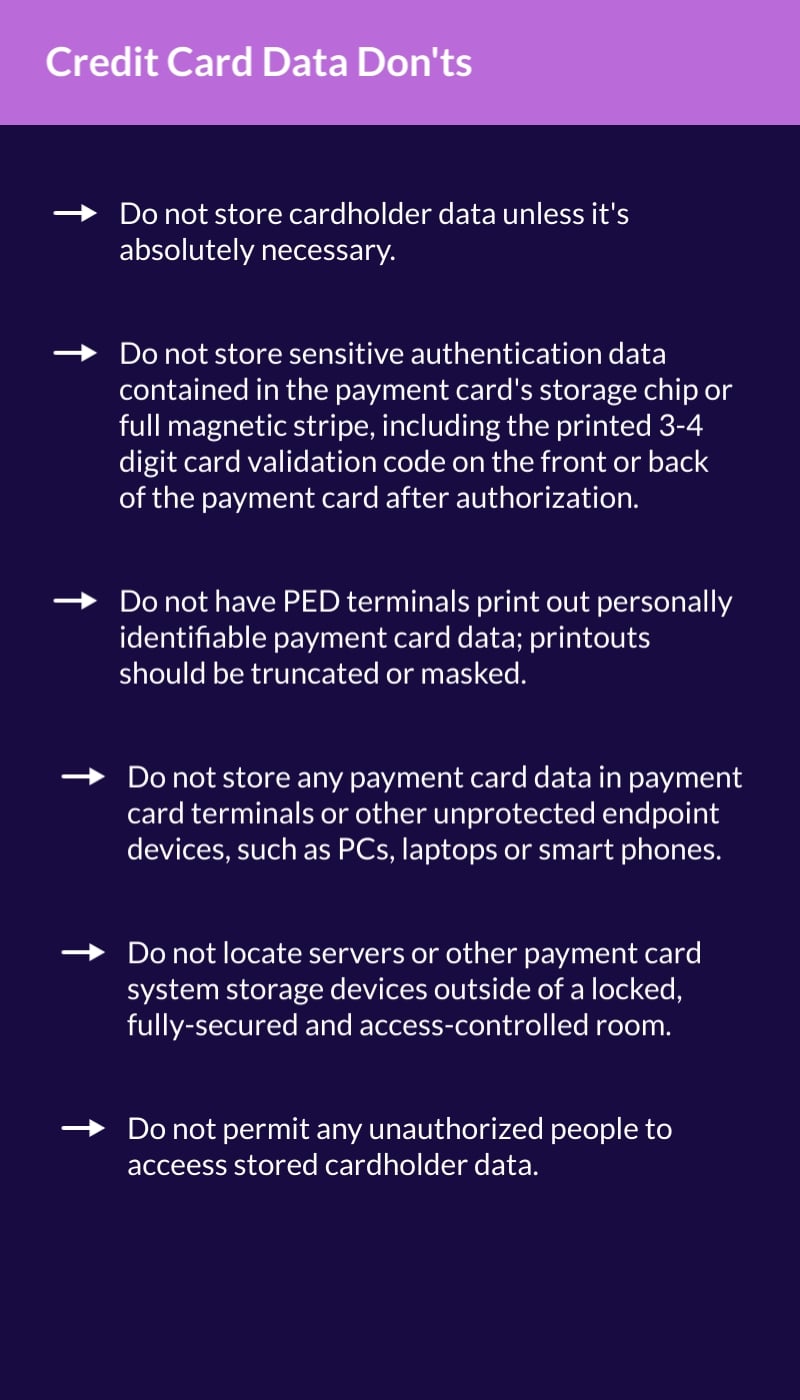

It’s important to note that PCI compliance rules do not allow for the storage of sensitive authentication data.

This means, full magnetic strip data, the three-digit code on the back of a card (known as CVV, CID, etc.) and the card’s PIN must not be included when storing credit card information.

Best Practices of Storing Credit Card Information

Depending on the other policies and procedures within your organization, there are best practices that can help with storing credit card information and keeping customer data safe.

- Use a payment vendor to store credit card information for you. Instead of capturing and storing information within your system of record, choose a payment vendor that handles those steps for you. When choosing a payment vendor, look for Level 1 PCI compliance and tokenization and encryption security measures.

- Don’t keep hard copies of payment information. Keeping paper forms containing card numbers is usually unnecessary for companies that use digital payment strategies. If you must store credit card information, you should keep it in locked filing cabinets or other secure locations.

- Restrict access to sensitive information to limit who can view and use payment data. The more people in your organization that have access to card information, the more chances there are for mishandling or fraud. Those who don’t need to view card data for their jobs should not have access to it. In addition, you should provide secure shred bins to properly dispose of private information.

- Don’t record card data on agent-assisted calls. Instead, you can use Flow to send a payment request. Consumers can fill out a payment form in real-time without having to reveal data to your agents.

PDCflow offers a variety of features and functions that keep customer payment details secure and make payment compliance easier for your business.

From secure agent-assisted payments to encrypted, tokenized payment storage (and beyond) PDCflow can help simplify security, streamline workflows, and boost customer satisfaction.

Request a demo with a PDCflow payment expert today to learn more.