Running a business comes with many internal and external concerns, from training and team management to focusing on brand reputation. But if your company has excessive outstanding invoices or delayed payments, cash flow will stall and the health of your business will suffer.

Reduce late payments from customers, keep revenue flowing and free yourself up to focus on other aspects of your business with these three tips to minimize outstanding and overdue payments.

1) Establish Clear Policies And Procedures

The easiest way to decrease how many outstanding invoices you have open at once is to clearly define expectations both to your customers and to employees in your AR billing department.

Customers need to know how they will be billed, when payment is due, and what happens if they fail to pay on time. Customer service staff should be trained to discuss policies clearly, especially concerning late or overdue payments.

Credit Policy

Your credit policy should outline the rules for granting credit and managing outstanding payments. Be transparent about how lenient or strict your company is with granting credit and the procedures you follow if a customer falls behind on payments.

You need to define the credit policy your employees must follow and make this information readily available for customers. Explain your company’s rules for when you grant credit to consumers and what criteria you use.

When writing or updating your policies, ask yourself: Is every customer held to the same standards? Do your staff or customers struggle to understand your terms for granting credit?

Outline policies as clearly as possible and make this information publicly available for customers to access. Some areas to consider when granting credit to customers:

- Determine your level of leniency: Are you strict on how credit is granted? If you run checks or review histories, the answer is most likely yes. If you offer goods and services on credit with no prior validation, you are probably more lenient with your policy.

- Do you make exceptions? Are there times you are willing to make exceptions for customers who would not usually be granted credit? If there are exceptions to your usual decision-making process, outline these in the policy as well, and train employees how to communicate the information.

- Customer/employee interaction: Your office structure and business model will determine how many employees a consumer interacts with during a transaction. To decrease the likelihood of an outstanding invoice, it is best to notify customers who from your organization will be reaching out during the invoicing and payment process and the channels they will be using.

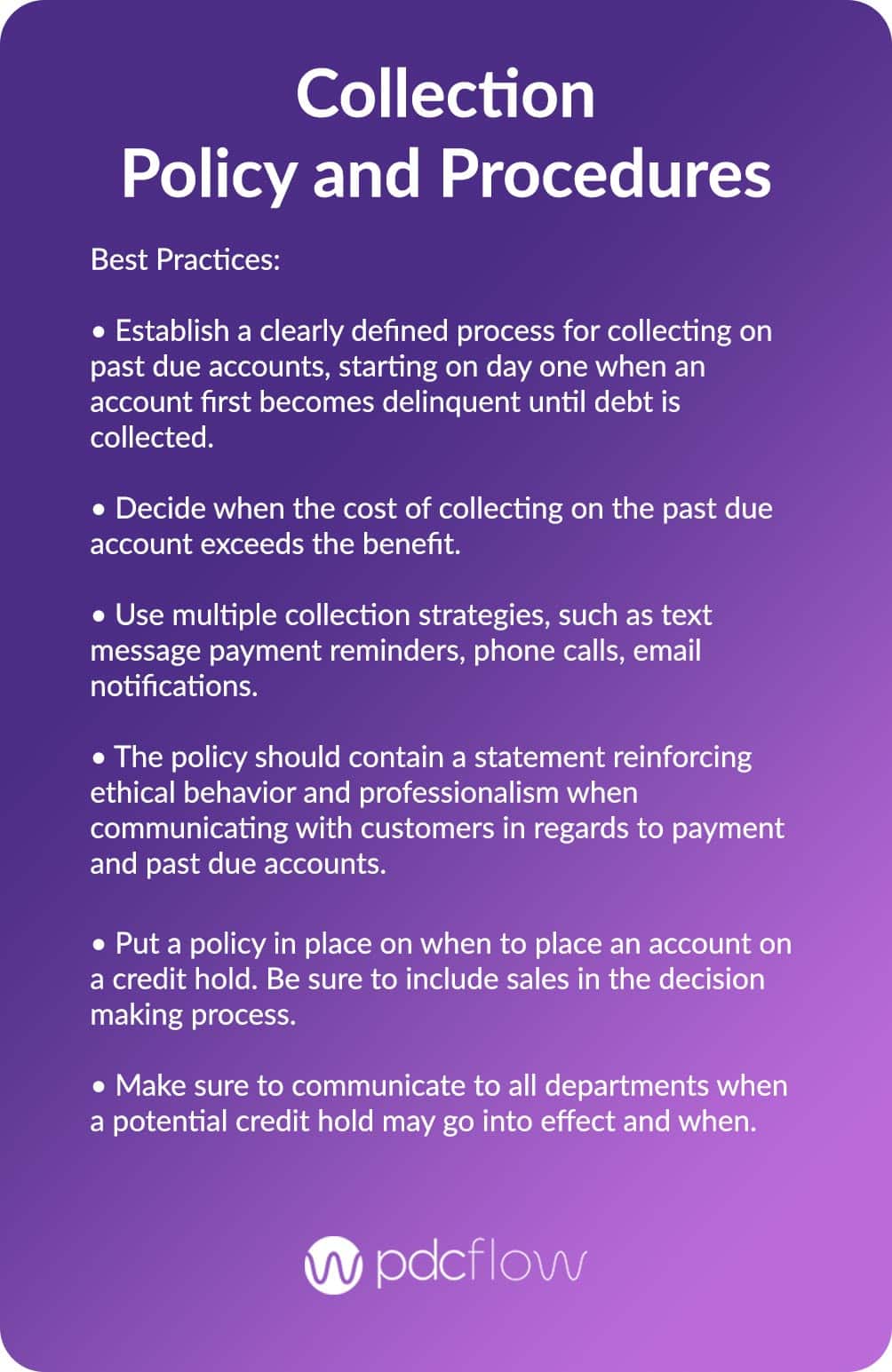

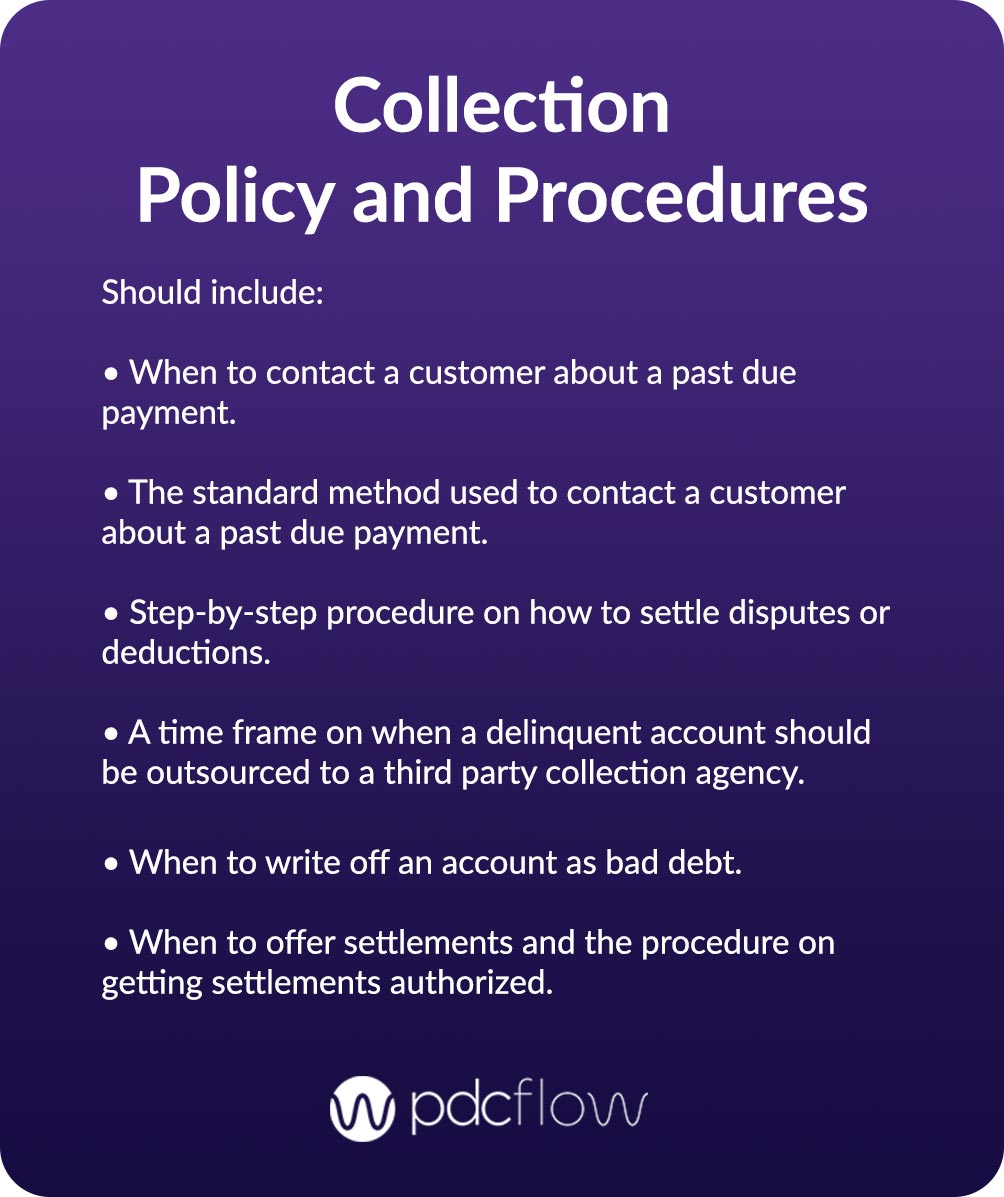

Past Due Collection Procedure

Written procedures aren’t just important during the sale; they are critical for managing late or overdue payments. Your business must have a plan for how each account is expected to be settled.

As with a strong credit policy, your business must have a clear plan for settling accounts. A well-defined collection procedure can inform customers of their responsibility to pay a debt and the consequences of delayed or overdue payments.

This approach will reduce outstanding invoices, enhance your brand’s credibility, and ensure smoother interactions between your AR department and customers.

Make sure your AR department and customers know:

- Expected payment terms: How long do customers have before they must pay? Do you offer recurring payment schedules (both via staff help and self-serve payer created schedules on your payment portal)?

- Payment reminders: Does your office send payment reminders by text message or email? If so, this must be communicated at the time of sale. Opt-ins should be collected before you begin communications and customers should be allowed to easily opt out at any point.

- Late payment fees and interest: Will you charge a late fee or interest on overdue payments? Present this information to consumers at the time of sale so they understand their obligation and are not hit with surprise costs in the future.

This transparency can prevent misunderstandings and encourage customers to pay on time, reducing the chances of having outstanding invoices.

- Payment incentives: Will you offer incentives such as discounts for paying bills early or upfront? Offering such incentives can encourage consumers to make more timely payments.

- How many follow-ups: You may not need or want to tell customers how many follow-ups they should expect. However, you should include this information in a policy and procedure document that can be internally accessed by your accounts receivable department.

- Third Party debt collection: If you use a third party for collection of seriously delinquent payments, you may want to let consumers know. This way, if they are contacted about old debt that originated from your company, they will not be suspicious of the debt collector or agency that contacts them.

Informing customers that a third-party debt collector might contact them for seriously delinquent payments can prevent confusion and ensure they take their payment obligations seriously.

As part of your internal collection procedures, you should also establish a follow-up timeline your employees can reference. You are likely to have accounts at many different stages of payment.

Treating a customer in the early billing stage the same as someone with a 30 days past due invoice is a bad customer service practice. Mishandling customers during payment (the least fun stage of any buying process) may even discourage customers from making future payments on time.

2) Capture The Right Information

When your business offers goods or services on credit, you run the risk of client nonpayment. The odds will be even higher if you aren’t capturing the proper information during a sale. Train all employees to obtain:

Basic Demographic Information

- Full name

- Telephone number

- Alternate phone numbers

- Address

Preferred Contact Method

- Text message

- Telephone

- Paper letter

Opt-In Consents

- For all digital communication channels that apply

Why?

The more relevant information you capture, the easier you will make the invoicing and payment process. For instance, customers are now more used to – and often prefer – digital communication channels over traditional paper invoices.

Offering to send invoices and payment reminders by text or email will decrease late payments by offering a faster, more convenient digital payment option.

As younger generations become a larger portion of a customer base and technology advances, it will become essential to offer electronic invoice management and digital payment options.

Complete information isn’t just a necessity for your billing department. If your company outsources early out collection to an Extended Business Office (EBO) or delinquent account collection to a third party, your employees need that information too.

According to the CFPB’s Regulation F, debt collectors are officially allowed to widen their use of digital communication. This fact and the Bureau’s new validation notice guidelines mean that you, as the original creditor, are responsible for collecting and passing along the data points they require.

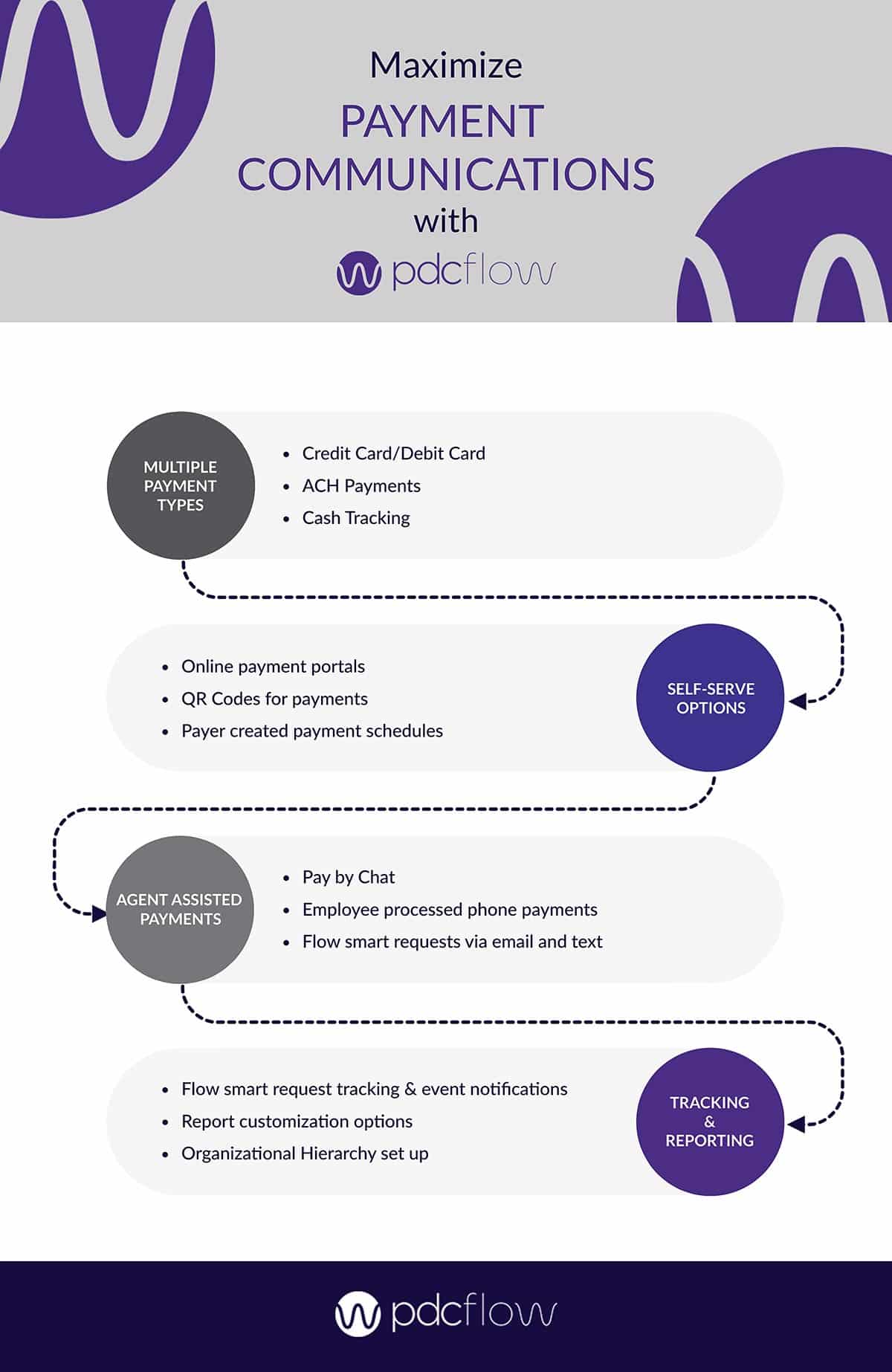

3) Implement Multi-Channel Collection

Another tactic to decrease late payments (perhaps the easiest way) is to offer your customers more choice. Not everyone is going to have the same communication preferences, work the same hours or pay bills the same way.

Multi-channel collection strategies allow customers to choose the payment method that best suits them, reducing the chances of delayed payments.

Multiple Payment Types

- Credit card/Debit Card

- ACH Payments

Self-Serve Options

- Online payment portals

- QR Codes for payment

- Payer created payment schedules

- IVR Payments

Customer Representative Assisted Payments

- Pay by Chat

- Employee processed payments

- Recurring Payment Schedules

- Email and Text Message Payments

Technology Integration

Use digital tools like PDCflow’s Flow Technology to streamline payment communications, reduce outstanding invoices, and improve cash flow.

Workflow event tracking and customizable reporting can help your business manage payments more effectively and reduce the number of overdue payments.

PDCflow's Flow Technology gives you:

- Email and text message payment communication (with opt-ins/opt-outs)

- Digital payment reminders

- Workflow event tracking and notifications (track every payment stage as customers go)

- Comprehensive and customizable reporting

In the end, using digital tools to send invoices, payment reminders and payment requests is one of the simplest ways to decrease late payments and increase revenue. The process is easy for your employees and streamlines payment communications for your customers.

Capture more payments before they become bad debt and simplify your workflows. To save time spent on manual tasks, request a call with a PDCflow Account Executive today for more information.