Managing the money customers owe your business is a vital – often overlooked – part of maintaining a healthy business. If your accounts receivable (or billing) department could use some attention, start with the basics.

Here’s a glossary of accounts receivable definitions and terms every AR billing professional should know.

DEFINITION OF ACCOUNTS RECEIVABLE

What is Accounts Receivable (AR)?

Accounts Receivable Aging Report

Accounts Receivable Outsourcing

Allowance Method

Bad Debt

Balance Sheet

Cash Conversion Cycle

Cash Flow

Direct Write-Off Method

Accounts Receivable Turnover Ratio

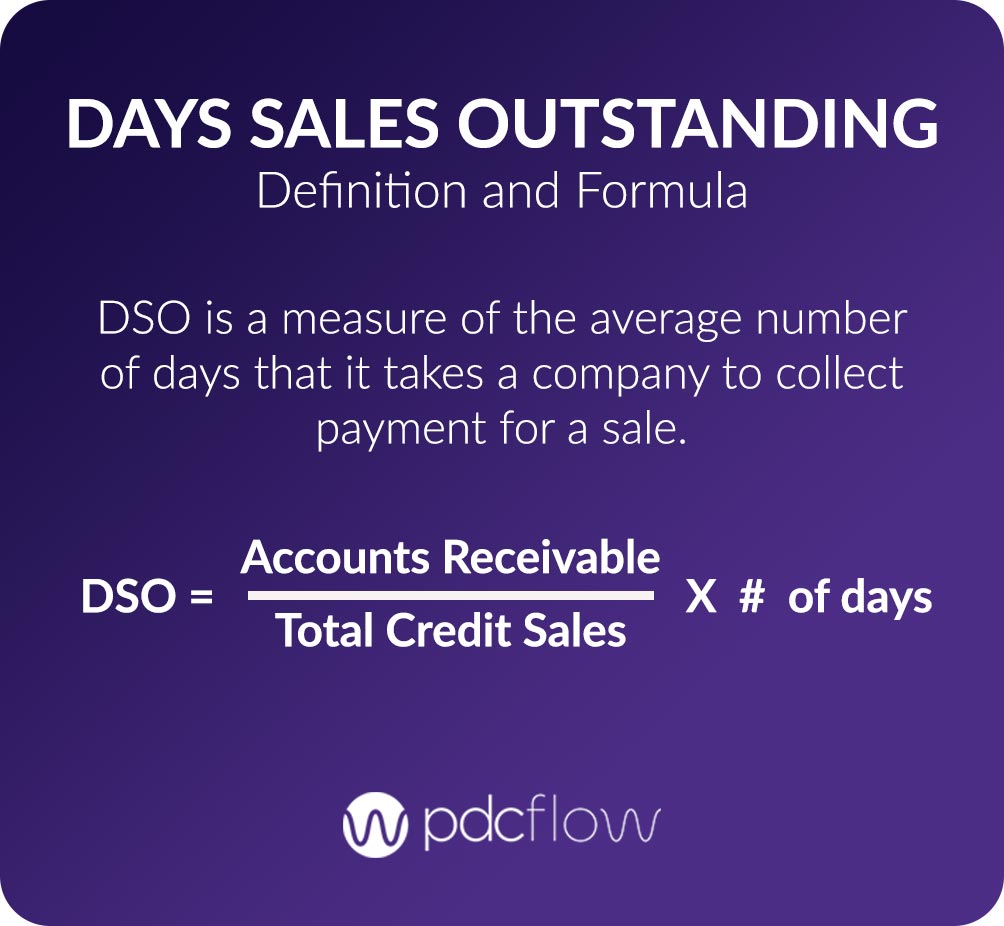

Days Sales Outstanding (DSO)

Often, AR departments measure their outstanding accounts as the average number of days it takes to collect a payment, rather than in dollars. If your days sales outstanding calculation or DSO calculation indicates a long cycle before receiving payment, your AR department could probably do more to improve the collection process. The (DSO) days sales outstanding formula is:

DSO = Accounts Receivable/Total Credit Sales X Number of Days

Keep Your Days Sales Outstanding Ratio Low

Businesses strive to keep their average number of days to collect to under 30 days. Sales need to convert to cash or the sale doesn’t matter. This puts businesses in a difficult position at times. It is important to provide a good customer experience, but it is also important to ensure products or services are paid in a timely manner.

Software that automates your accounts receivable processes will help keep your average DSO low and create a good experience for your customers.

PDCflow provides companies with a full payment suite for businesses to offer convenient, safe payment options to their customers. Along with this, companies can use Flow Technology (our outbound message delivery system) to simplify the way you engage with customers about their payments.

With PDCflow, you can:

- Capture and store payment data

Capture payment information for future payments when a sales order or contract is signed. Flow Technology works by letting your sales team roll several actions into one workflow and send it all at once to customers. The customer commits by signing your sales order and entering their payment information. The payment is stored securely and can be used for all future invoices.

- Create one-step workflows

Send invoices, billing statements, and payment reminders to customers through email and text. With unlimited templates and user set up capabilities, your entire sales team and accounts receivable department can have the templates they need ready to send with just one click.

Speak to a PDCflow payment expert today to learn more about PDCflow’s payment communication software and how automating your accounts receivable processes can help keep your business cash flow healthy.