Collector.Live! has wrapped up another program full of speakers, panels and inspirational knowledge. Front line collectors gained insight on everything from the impacts of Regulation F to the positive impacts of mental rehearsal on job performance.

One such speaker, Dr. Joshua N. Weiss, who is a negotiation and conflict resolution expert and President of Negotiation Works, Inc., taught attendees the benefits of using four core negotiation tactics during collection.

Joshua Weiss

1. Tactical Empathy

Everyone wants to be understood. Being in debt can be distressing and the situations that can lead to debt may impact a consumer’s state of mind during the first consumer contact and beyond.

Weiss says the empathy you show consumers during this time is critical and can serve dual purposes. Showing empathy is the right thing to do when you see consumers are struggling, but it can also help to aid you in negotiating payment plans. This approach is called tactical empathy.

What is Tactical Empathy?

WHY IS TACTICAL EMPATHY AN EFFECTIVE NEGOTIATION TACTIC?

Three Aspects involved in Tactical Empathy

To engage in tactical empathy for the purpose of payment negotiations, there are three things to keep in mind.

- Tone of voice - Focusing on tone of voice during negotiation is essential. If you sound angry, combative or rude, the person you’re speaking to will not be receptive to what you are offering regardless of what it is.

- No denial or disagreement - Do not deny the validity of the other’s views. Voicing denial or disagreement can stall conversations and even set back progress you’ve already made during the negotiation.

- Make them feel heard - Validating a consumer’s point of view is essential to moving forward during a call. Many people want to share the story of their debt or provide their reasons for the situation they are facing. Validating that you have heard them and understand what they’re saying creates trust. This respect during business negotiation helps you move toward the end goal with a more favorable outcome.

Business Negotiation Tactics

Validating Language Examples

"That sounds really challenging"

"I appreciate you sharing that with me"

"I can understand the uncertainty you feel"

"I know this is a challenging time"

2. Modes of Persuasion

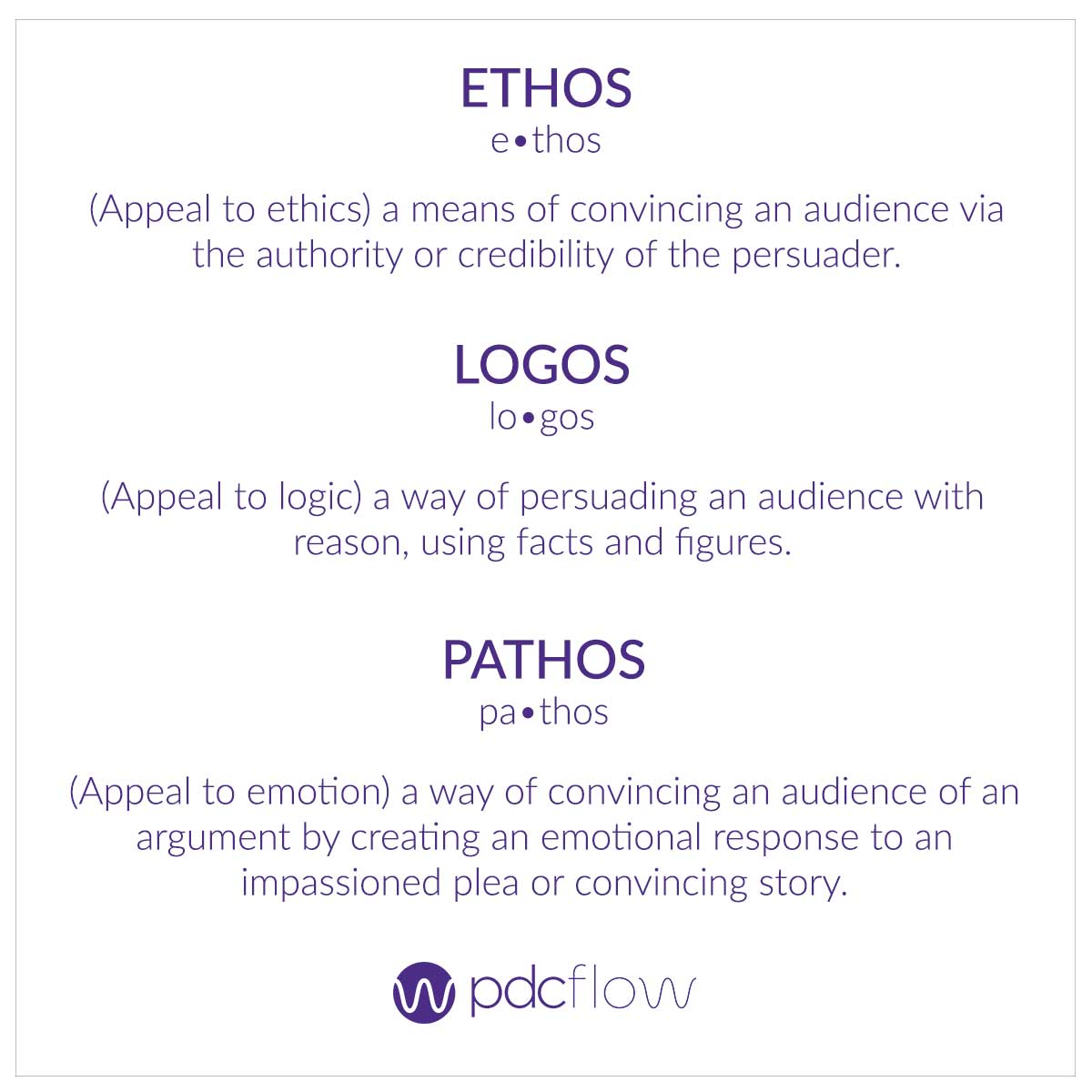

There are three well-known modes of persuasion, first taught by Aristotle, that are still used today in speeches, persuasive readings and negotiation. These three modes are Ethos, Logos and Pathos.

Ethos is about your credibility and trustworthiness with those who you are trying to persuade. Logos relies on logic and reasoning in your argument.

However, Weiss says the third mode, Pathos, is an often underutilized approach in negotiation.

The pathos mode of persuasion involves an emotional connection or bond that you create with the other (in this case, your consumer).

According to Weiss, the best way to build this relationship is through stories, past experiences, and precedence. For example, consider sharing a past consumer’s experience that is similar to your current negotiation.

Telling your consumer how you were able to help others in the same situation is very persuasive. They may feel relief that you know how to help and understand that you are not in opposition to each other, but rather working together towards a shared solution.

3. Getting Creative (Instead of Using Compromise)

Once you understand the basic components of successful negotiation tactics, it’s time to become comfortable putting the pieces into practice. Here are three areas of the negotiation process where you can use creative thinking to reach your goal.

- Understand their underlying interests - Sometimes during negotiations, you will discover that what people think they want and what their underlying interests are don’t align. Asking open-ended questions, using empathy, and listening closely can help you understand the motivations driving a consumer. This can be a powerful tool for providing a win-win outcome they may not even know is available.

- Get them into problem-solving mode - After you have laid the groundwork with a consumer by showing empathy and grasping their underlying interests it’s time to start working toward a mutually beneficial solution. Once you’ve created a bond and shown that you are trustworthy, you can motivate the consumer to participate in problem solving. Remember, if you frame the situation as working together, consumers are going to be more willing.

- Compromise as the last resort - Compromise shouldn’t be the outcome you strive toward with your business negotiation strategies. Create a clear set of goals you’d like to achieve. Ideally, these goals will be acceptable to the other party as well. Try everything else before compromising because you might find that compromise is not necessary.

4. BATNA Analysis (Yours and Theirs)

After understanding the best negotiation tactics to use, you must do one more task before you dive in. Your Best Alternative To a Negotiated Agreement (BATNA) is a way to plan for every outcome. If the conversation doesn’t go the way you imagine, you need to know what you will do at that point.

Ask yourself a few key questions in order to do this preparation:

- What happens if we cannot reach an agreement?

- What will I do?

- What will they do?

If you mentally prepare for these scenarios, and you understand your and their BATNA, you will find yourself better prepared and clear on what you should and should not accept.

Reality Testing Questions

Weiss acknowledges that sometimes, despite your best efforts, you will still be met with resistance from consumers. This is often the case when the consumer’s BATNA is poor.

Weiss says to stay persistent in your personal negotiation goal, and ask reality testing questions to get past this resistance. Ask the consumer about the weaknesses of their situation and what happens to them if you can’t reach agreement.

Of course, in debt collection, you may find yourself limited by regulations from specifically telling a consumer what may happen if they don’t pay their debts. Speak to your compliance managers to create a compliant rebuttal call script that still accomplishes the goals of a traditional reality testing exercise.

Weiss leaves us with this thought, “A good negotiated solution requires careful preparation, empathy, creative problem solving, and a clear understanding of your and their BATNA. If you have thought all of these things through and follow these four tips your chances for success will be greatly enhanced.”

Looking for more strategies to resolve delinquent customer invoices? Check out this Guide to Payment and Negotiation Strategies for Unpaid Accounts.

Subscribe for weekly updates or to our monthly newsletter for more actionable insights, tactics and expert advice to improve the payment experience for your customers and create a better cash flow.