Digital debt collection, while not a new idea, has been difficult for many to implement compliantly in the past. Now, through Regulation F and the emergence of new debt collection technology, the debt collection industry is finally beginning to see a digital transformation.

Debt Collection agency operating models have begun to include more digital tools and the future of debt collection is likely to bring even more exciting changes. Whether you’re interested in workflow optimization, greater customer engagement or simply an increase to your bottom line, a digital debt collection strategy can help.

WHAT IS DIGITAL DEBT COLLECTIONS?

Using text, email and other digital channels for outbound communication.

Providing digital inbound self-service options.

Evaluating and updating a debt collection technology stack.

Improving customer experience through technology. The ability to scale through digital channels.

A Customer Centric Solution

The measure of success in business is how happy customers are with their experiences. Improving the customer experience through digital debt collection technology can be a big win for companies struggling to engage people in the payment process.

You can begin building a customer centric approach to debt recovery by understanding what consumers want and what the industry climate demands.

Shifting Customer Preferences

The way people communicate has changed drastically over the past few decades. Fewer people are answering telephone calls and more people are interested in modern, preferred digital channels to interact with companies.

Consumers are interested in self-service options, alternative forms of communication like email and text messaging, and other digital channel communication options that enhance the customer experience.

Regulatory Environment

Before Regulation F was released, many debt collectors were nervous that alternative collection strategies would result in litigation. Now, text messaging and email are both indicated as acceptable types of communication for collection agencies – so long as you keep compliance in mind.

The Bureau is hoping to encourage a customer service approach to collection services, so those paying debts can better control the method and timing of the communications they receive.

Digital Debt Collection Channels

Outbound Communication

Outbound communication is challenging. Offering options like email or text messaging – in addition to traditional strategies like phone calls – shows consumers you have their interests in mind.

Allowing people to access messages from you in the least-demanding channel for them establishes respect for their needs and helps to build trust.

Inbound Self-Service

Consumers making a payment should encounter minimal roadblocks, and should have as many options as possible to best serve their needs. An agency's payment collection platform should be able to accommodate the most common inbound channels. These include:

- Online payments - Online payments are one of the simplest digital tools to immediately provide you with results. People want a way to pay bills online without having to speak to an agent.

- IVR - An IVR system is a way to filter consumers directly where they need to go before involving one of your agents.

- Machine learning - If your agency is hearing a demand for customer service through chat, AI chatbots may be necessary. Much like IVR, they can qualify the consumer’s issue, going a step further to offer resources before involving a live agent.

- Online chat - Chat services allow customers who are embarrassed about their debts a level of anonymity they may not feel on the phone. Accepting web chat payments can make settling debts easier.

Evaluating and Updating Your Tech Stack

Obviously, digital debt collection can’t happen without the proper tools. Within your organization, you need to begin making observations about the gaps in your processes, friction points in your digital customer journey and compliance necessities.

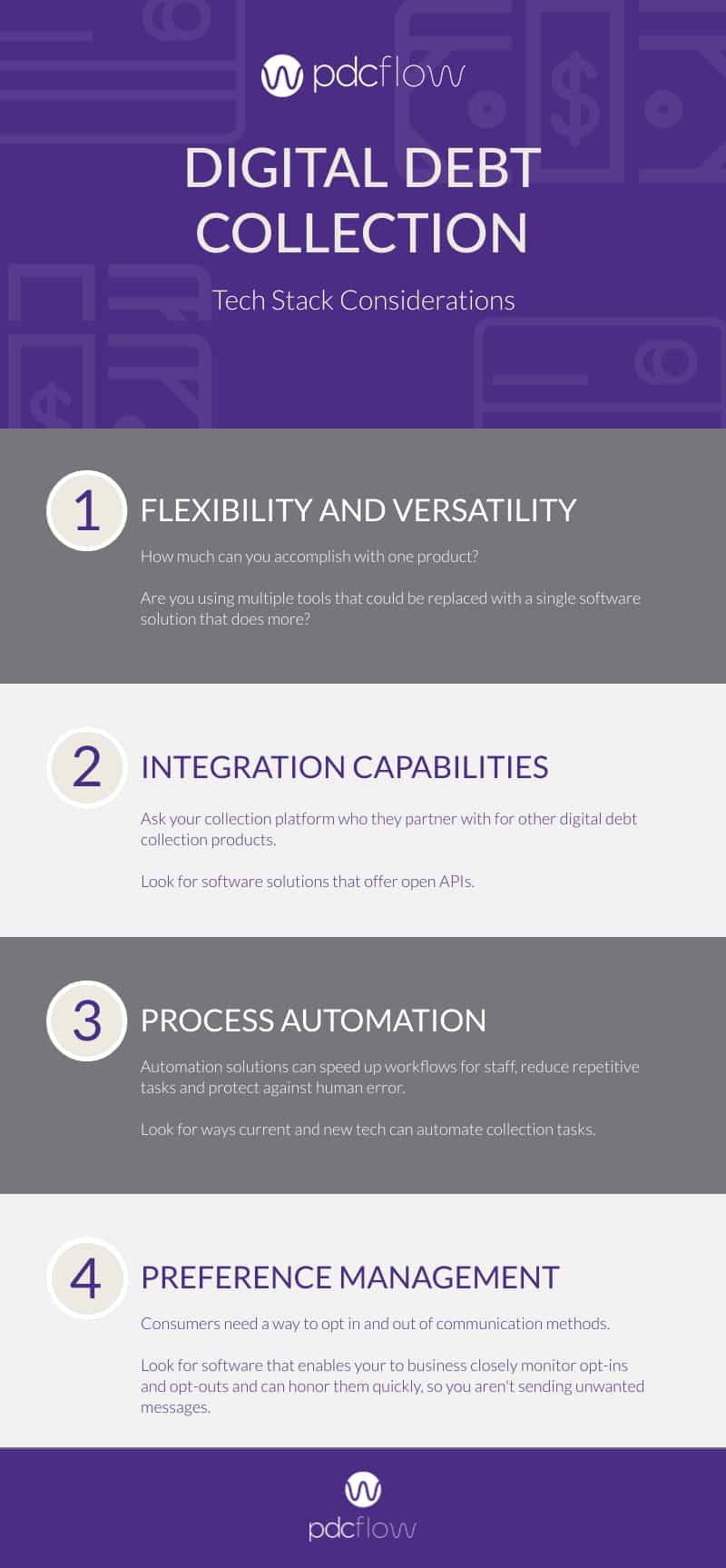

This will make it easier to audit current tools and add new ones to your tech stack. Here are some considerations to start with:

- Flexibility and versatility of debt collection solutions - how much can you accomplish with one product? Are you using multiple tools that could be replaced with a single one that does more?

- Collection platform integration capabilities - If it’s important to have all your information within a single system, ask your collection platform who they partner with for other digital debt collection products. If your company has internal development capabilities, look for open APIs.

- Process automation - Automation solutions can speed up workflows for staff, reduce repetitive tasks and protect against human error. Look for ways current and new tools can automate collection tasks.

- Preference management - Consumer preference management has become increasingly important. People need a way to opt out of communication methods they don’t like. In addition, your company needs to closely monitor the opt-ins and opt-outs, and be ready to honor them quickly, so you aren’t sending unwanted messages.

Results of Digital Debt Collections

Greater Customer Engagement

Engaging consumers is especially difficult when you are asking them to pay a bill. They may not think they can afford it, they may be embarrassed about the debt or they may have some other reason for avoiding the issue.

Others, especially those from younger generations, are more likely to prefer email or text messaging simply because they dislike talking on the phone.

Using technology to engage these consumers in the ways they are most comfortable with breaks down barriers to payment and increases overall engagement.

Higher Response Rates

Higher Recovery Rates

Many companies, like PDCflow customer Assistentcy LLC, have experienced this change firsthand.

Struggling to get consumers to commit to payment, Assistentcy adopted Flow Technology and began sending electronic communications to help resolve accounts. Implementing this single tool nearly doubled their card payments.

Learn more about how Asssitentcy LLC uses Flow Technology, review the case study.