As Joann Needleman, attorney at Clark Hill, explained in a recent webinar, the CFPB’s Notice of Proposed Rulemaking (NPR) is intended to make debt collection practices uniform. If everyone operates the same way, though, how will you stand out? This is where a customer service strategy for your collection agency can make a difference. To differentiate yourself, prepare now to provide a pleasant, customer centric experience to consumers through limited content messages, empathy and updated communication technology.

Why Is Adapting To a New Strategy Important?

Standing out isn’t just about showing clients you do things differently. Focusing on customer service can help improve receivables and lower consumer complaints against your agency too.

Educate yourself on limited content messages and other tools you may soon be able to use to engage with consumers. How your agency reaches out and how collectors act once contact is made will impact how successfully accounts are resolved. Those who find themselves in collections may owe multiple debts. Provide convenient communication channels and excellent customer service. These factors may convince a consumer to resolve their debts with your agency first.

How Can Limited Content Messages Factor In?

With the shift from home phones to mobile devices, more consumers are opting not to answer calls from an unknown number. Part of this comes from spam and scam mislabeling of collection phone numbers and call blocking apps that are becoming increasingly popular. However, leaving a telephone collection message could potentially violate third party disclosure rules.

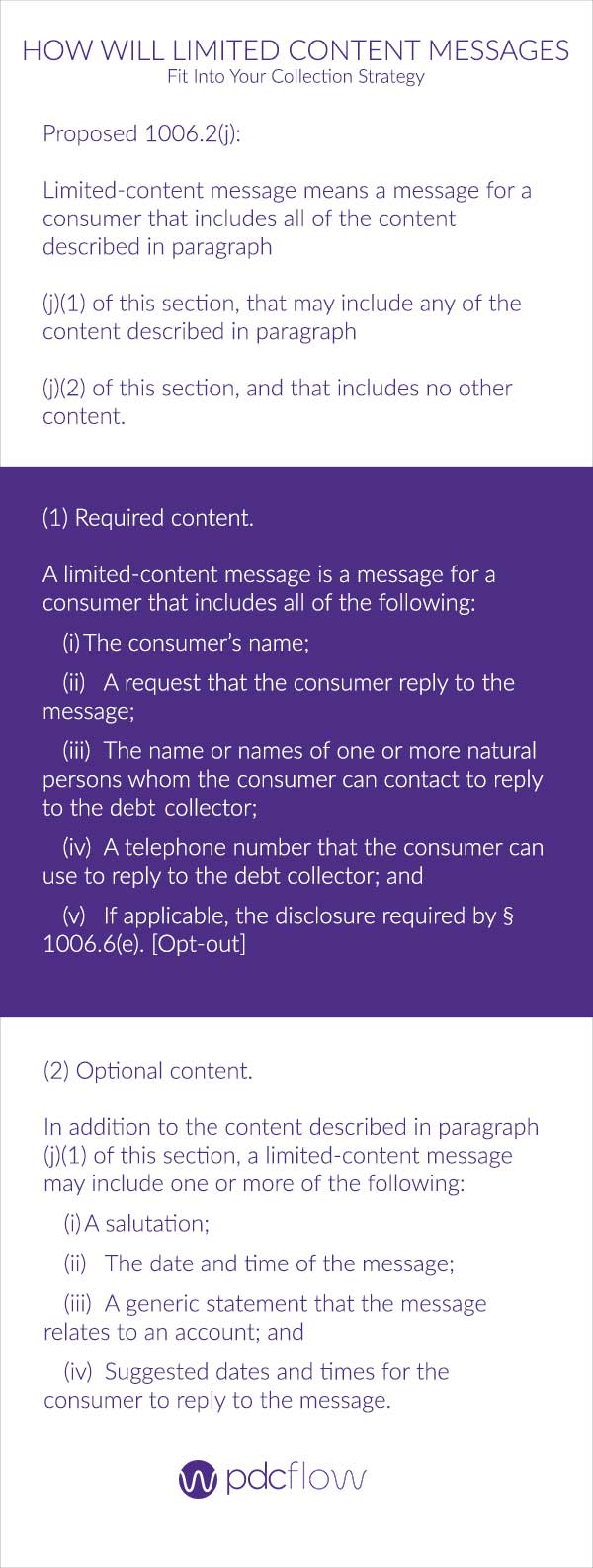

The Bureau recognized the dilemma that has been created through the shift in communication technologies and proposed a solution in the NPR – the limited content message. The CFPB suggests generic language to be used in leaving a message so that a consumer’s privacy isn’t violated, yet they still have knowledge of who has called.

How does this add up to customer service? Limited content messages will help debt collectors stand out from a sea of missed calls from unknown numbers. Without the fear of being sued for leaving a message, more collectors will do so, and more consumers are likely to call back. Being able to leave a message also decreases the need for collectors to call a consumer too many times, hoping they will eventually pick up.

These positives all add up to a better experience for consumers, who are less likely to feel privacy has been violated, or that they are being harassed through excessive telephone calls.

Other Ways To Serve Consumers

Of course, taking advantage of limited content messages is only one aspect of a fully-formed collection strategy. Many different tactics should be used to provide convenience and a human touch to resolving debt.

Use Your Website

Building a strong brand identity is an important step in gaining consumer trust. While brand identity is communicated through many channels, your website should be where everything about your company is housed.

Since many consumers are likely to check you out online to ensure your agency is legitimate, take advantage of this opportunity to present yourself to consumers.

- Maintain consistent brand colors/fonts. Changing logos, colors and other brand identifiers may mislead or confuse website visitors. Make sure all web pages and styles match.

- Make the site easy to navigate. If your website is confusing, visitors are likely to leave before finding the information they are looking for.

- Clearly state your business. Vague phrasing may cause concern. Use language that people outside of the debt collection industry can understand, so they know your agency is above board.

- Offer an online payment portal. Some consumers prefer to resolve their accounts without speaking to a collector, or outside of business hours. Online payments are a great way to serve consumers who would rather take care of payments without speaking to an agent.

Teach Collectors Empathy

Owing a debt can be a stressful situation. Consumers may feel embarrassed about talking to a debt collector or even become defensive. Many collection industry experts now agree that the best way to connect with consumers is to practice empathy for the difficult situations they may be facing.

Leslie Bender, Chief Strategy Officer and General Counsel at BCA Financial Services spoke at Collector Live early this year about the importance of learning conversational intelligence. One of the “basic truths” of debt collection she emphasized was that every agent is a consumer advocate. Bender says being a collector puts agents in a direct position to help consumers and should strive to do so in every interaction.

Sabrine Salti of American Profit Recovery and her co-panelists on a recent webinar, Speaking The Language of Different Generations When Collecting, all agreed that empathy is key to collecting – no matter what generation a consumer is from.

Beth Conklin, ACA Certified Instructor, and Account Executive at State Collection Service, Inc., says that empathy can make or break the vital first consumer contact. Oftentimes the first consumer contact may be the only consumer contact. During this vital time, collectors should practice feeling and showing empathy to build trust with consumers and open an honest dialogue about resolving the account.

Adopt Electronic communication

Text message and email are becoming the preferred methods of communication for a large number of consumers. Many don’t like to talk on the phone and prefer to control the manner and pace of their conversations to fit around daily life.

Adopting text and email to accompany traditional collection efforts will provide convenience for consumers and empower them to take a more active role in resolving debts. To learn more about the advantages of using digital communication in accounts receivable, download our comparison chart: