What are Embedded Payments?

Embedded payment systems should be available anywhere hassle-free transactions could enhance your company’s user experience.

Embedded payments integrate payment processing into a software application or a platform. Unlike traditional financial transactions that require you to switch from one platform to another, embedded payments happen within the existing user interface.

For example, instead of being redirected to a third party site when clicking "Pay Now," you make your transaction right there on the payment page without ever having to leave the website.

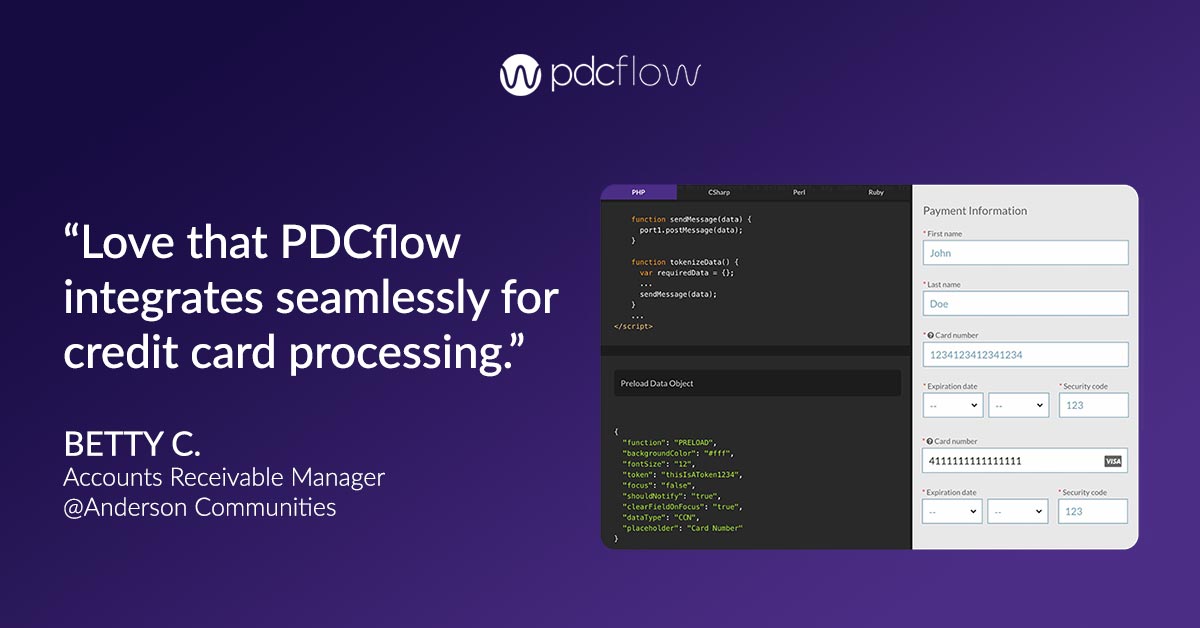

PDCflow APIs For Embedded Payments

Companies can embed payment workflows into their existing systems through APIs. It’s important to find fast, easy, low-effort integration options. PDCflow’s API integrations:

- Are developer friendly - PDCflow offers support during the integration process. Lean on the development team for help and test functionality through a sandbox account.

- Are low-code - PDCflow APIs are low-code. This makes it easy to get integrations done faster, with less development work.

- Offer drop-in components - PDCflow APIs offer some pre-built drop-in components. Embed payment and communication workflows with minimal effort.

Benefits of Embedded Payments

Adding payment integration directly into business platforms and consumer apps offers benefits that go beyond processing transactions. Here’s what embedding payments can do for you:

1) Reduced Friction and Enhanced User Experience (UX)

The payment process shouldn’t be long, drawn-out, or take customers to a page they don’t recognize. After all, it’s easier for customers to pay when they don’t have to leave your website.

It’s also a better user experience for your own employees if you embed payments into your customer workflows.

Reduced friction and streamlined payments let customers self-pay, cutting down on the amount of customer service calls you receive from people trying to understand how to pay.

2) Better Revenue Stream

Customers often abandon payments if the process takes too long or if they are unexpectedly redirected to another site.

Embedded payments do more than just simplify the payment process–they increase revenue by boosting the overall number of successful payments.

3) Increased Engagement and Loyalty

Customers want reassurance that their data—especially payment data—is going to remain safe. Take care to ensure a secure, transparent, embedded payments process to maintain trust, engagement, and loyalty.

4) Data Insights

Embedding payments into your current applications makes it easier to see payment reporting insights at a glance. Payment integrations make it possible to access everything you need all from one system of record.

The Future of Embedded Payments

Embedded payments are now essential for online business.

Leveraging an integration partner like PDCflow makes it easier to offer ideal customer experiences and digital payment options that work.

What does the future of embedded payments look like?

Increased Accessibility

Personalization at its Peak

Embedding payments can go beyond simply offering payment options. Thoughtful use of this type of integration can result in entire workflows that simplify and personalize the user experience.

By embedding payments, each time your business communicates with a customer, it’s as non-disruptive and as natural as possible.

Every business will be expected to apply the types of improved processes that integrated, personalized payments enable.

For more information on how payment integration can improve workflows for you and your customers, request a call from a PDCflow Payment Expert today.