Share this Article

One-time payments to your company are necessary to accept from consumers, but for many businesses – especially those that run on accounts receivable – you need a recurring billing option within your payment software too.

Recurring billing is the practice of charging a customer in installments rather than in a lump sum. These payment schedules can be used to resolve:

- Large medical debts

- Monthly payments for legal services

- Past due debt

Payment Compliance and Consent for Recurring Billing

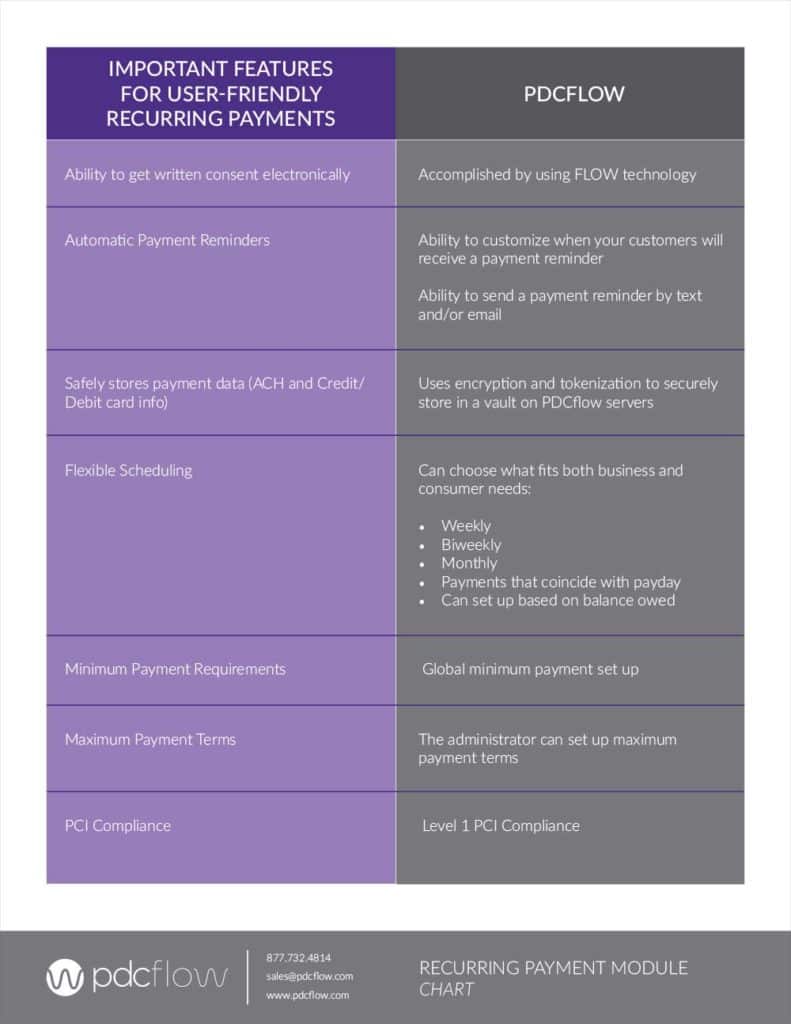

Recurring billing offers convenience to consumers. However, it’s important to maintain compliance with Payment Card Industry (PCI) standards and Regulation E when accepting credit cards and Electronic Funds Transfers (EFTs).

EFT Authorizations

If you plan to take recurring ACH or debit payments, there are other considerations to follow. Regulation E of the Electronic Funds Transfer Act (EFTA) states that businesses must obtain written consent on any EFT, including authorization before implementing a recurring payment schedule.

PCI Compliance

If your business accepts credit card payments (either one-time or recurring), you must stay PCI compliant with the guidelines the card industry has laid out. These rules are designed to keep sensitive consumer card data safe.

As a merchant, your business is responsible for knowing which of the four levels of PCI compliance applies to you, and what you are obligated to do in order to maintain this compliance.

Your payment software vendors should maintain PCI compliance as well. If recurring billing is important to you, be sure to find a payment software provider that can offer both features you want – like scheduled payments – and the safety you need through a commitment to data security.

Chargeback Prevention

Although credit cards aren’t EFTs, many systems do not differentiate between a credit or debit card at the time of payment. To avoid human error that may lead to a Regulation E violation, it is best practice to obtain payment consent on all transactions. This thorough consent policy can also double as a chargeback prevention strategy.

Forgetting about a charge is a leading cause of initiating a chargeback. When consumers agree to a payment in writing, they are more likely to remember it, decreasing the chances of forgetting about the next scheduled payment.

In addition, using an authorization tool that uses dual authentication, has a date and time stamp and captures geolocation can also protect your business against fraud and help to fight chargebacks later.

PDCflow’s FLOW technology, which is integrated into our recurring billing system, can accomplish all of these tasks without sacrificing workflow convenience.

PDCflow Recurring Billing - Frequently Asked Questions

How much does it cost to set up recurring payments?

PDCflow’s recurring payment module is included with your payment services. There is no extra cost for the feature, just the cost of your payment and FLOW services.

Can I charge a convenience fee on recurring payments?

No. Both NACHA and Visa have stated that merchants can not charge a convenience fee on recurring payments. PDCflow’s system does not allow convenience fees to be applied to recurring payments to help you comply with this regulation.

Will a schedule run if a signed authorization doesn’t come back?

No. The schedule will not run in this case. The schedule goes into an Authorize status and no payments will run if the schedule is in this status. Once the authorization is complete, the schedule goes to an Active status and payments process as expected. Users do have the option to activate the schedule manually if they choose without getting the authorization back.

Do I get a notice if a recurring payment fails?

Both the posting clerk and the consumer can be set up to be notified.

Does my customer get a notification if their payment fails?

Both the posting clerk and the consumer get notified. This is only true if contact information is entered in the right places.

Can I take a down payment or initial payment when setting up the schedule?

Our system does allow you to create a schedule from a one-time payment.