For decades, paper bills and telephone calls have been the standard tactic for collecting payments. Now, payment request email options are available (and expected) by consumers.

Using email to request payments and software that can capture customer payment information via email is popular, simple to implement, and creates a quicker way for people to pay their bills.

Why Use Payment Request Email Software?

Many companies are just beginning to send email payment requests, or haven't even started.

If your company is considering using email for requesting and capturing payments, here are some reasons to take the leap.

EMAIL FOR PAYMENT DUE IS FASTER THAN MAIL

Of course, speed is the most obvious advantage of requesting payments through digital channels. You can send payment request emails, or requests for signed authorizations on large payment amounts, or payment schedules to your consumers within minutes.

Eliminating the time for mail to be sent, received and returned shortens your revenue cycle and facilitates faster bill payment for consumers.

PREFERRED BY CONSUMERS

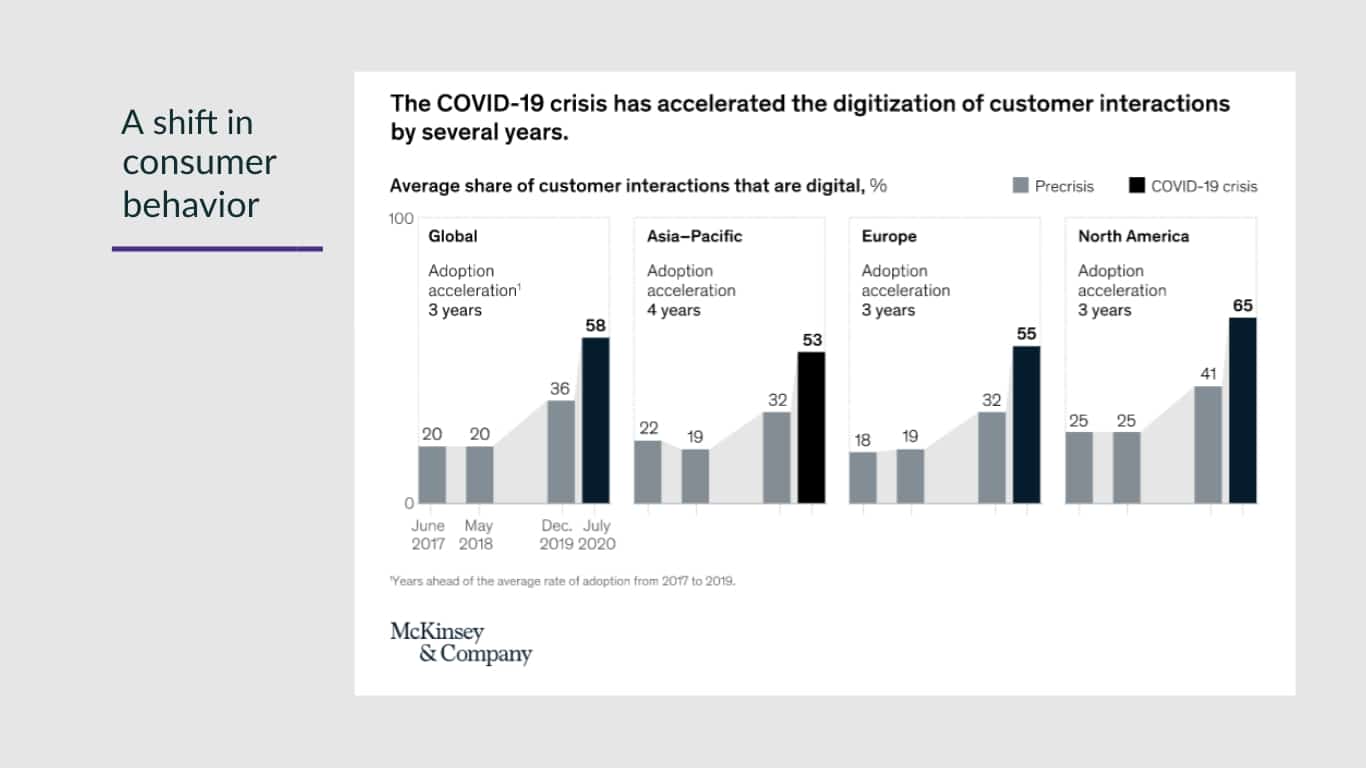

Over recent years, consumers have begun to ask for more digital solutions from companies. Choices for digital engagement, like online payment portals and email notification opt-ins, have become more popular than ever.

Part of this trend is because our world is becoming more comfortable with technology. Another part, however, has been driven by COVID-19 and the world’s unexpected demand for simpler, contactless ways to interact.

As your competitors offer more digital options and experiment with new ways to engage, you may find yourself out of favor with loyal customers if you aren’t listening to what they want.

CONVENIENT FOR BUSINESSES

Using email to request and capture payments isn’t just helpful to your customers. Adding email payment requests to your billing processes will:

- Cut down on mailing costs and letter vendor fees. Email payment requests cost significantly less than the expenses associated with paper mail requests.

- Give employees tracking and payment status notifications. Staff can access real-time reporting or sign up for electronic notifications. Track that your message was received, opened, and clicked, and that a payment was processed.

- Make it simple to share statements or other documents while on the phone. Agents can send payment terms, a past due invoice email, balance information or more. Consumers can review their bill while on the phone with an agent, boosting your credibility.

How to Write an Email for Payment Request

After picking the right payment request email software, your next consideration is to choose which workflows you intend to use by email.

PAYMENT REQUEST EMAIL CADENCE

Some of these payment request emails may be single emails sent on a one-time basis. Others may require follow-ups or internal monitoring to succeed.

Those collecting late payments should keep in mind any industry rules that apply to your communications, such as Regulation F. Also, think about the digital customer journey and how the experience will feel to the recipient.

Consider:

- Send times - you may be required to send (or not send) emails at certain times of the day. Adhere to guidelines and send emails at the most convenient time for the consumer.

- Number of emails - you may be restricted by regulations on how many emails you can send a consumer (like those collecting on third-party debt). Create your own parameters for how many times (weekly, monthly or total) you will send an email to your client about outstanding invoices.

- Email spacing - pay attention to the length of time you leave between emails. If you are sending a friendly reminder to resolve a late bill, this point is essential. Emailing too often may make your consumers feel annoyed or harassed.

Ways to Use Payment Request Emails

Along with customer satisfaction and saving money on stamps, email payment requests give you greater flexibility in your workflows.

Here are some different ways your organization can use email payment requests to improve collections and get paid on time.

DOWN PAYMENTS AND COPAYS

Contractors, healthcare facilities, and other companies that offer services before receiving payment may require a down payment or copay in advance.

Sending a payment request email along with a contract in a single message simplifies workflows for customers and speeds up the customer journey.

INVOICES

PAYMENT REMINDERS

PAYMENT AUTHORIZATIONS

Companies that facilitate Electronic Funds Transfers (EFTs) are required by law to comply with Regulation E. This regulation states that EFTs–which include taking payments from a consumer’s bank account–must be authorized by the consumer prior to the transaction.

Use software that allows you to send a copy of the payment schedule and the consent form directly to a consumer’s inbox. This lets customers sign a payment consent form and enter their own payment information within minutes.

DOCUMENT REVIEW

Misunderstandings happen. Sometimes, a customer won’t agree with what they owe or will ask for an itemized list of their expenses.

Software that allows a payment request email with an invoice is an excellent way to share documents with a consumer instantly. That way, they can view and discuss their statement with an employee to clear up any misunderstandings.

Request Payment Emails: Opting In and Out

Using email to request and collect payments can boost revenue and customer satisfaction. But properly handling those who opt in (and opt out) is essential to success. Make sure you have adequate reporting on who is opting in or out of your emails.

Use these reports regularly to manage consumer consent. It’s your duty as a business to understand how consumers want to be contacted and to honor their choices. For example, a consumer opting into email communications only should not receive phone calls.

Building and Maintaining Trust

Another component of using email for payment requests is the need to build trust. Customers may forget they signed up for emails from you, or even forget they patronized your business. In the case of debt collection, you may even be less familiar to consumers.

Remember, scammers are becoming more prevalent through phone calls and text messages, but they haven’t abandoned the inbox. If your company’s emails don’t look professional, you will quickly lose trust and potentially miss out on revenue.

PROOFING YOUR EMAILS

Read and edit all written, consumer-facing communications before sending them. Many spam or phishing emails can be identified by certain hallmarks. To differentiate yourself and create the best first impression:

- Avoid grammar and spelling errors - many scam emails are poorly written, so misspellings in your company’s email may cause red flags.

- Consistent branding and style - whenever possible, try to keep branding and style consistent. Don’t refer to your company by an acronym in your emails if you don’t refer to it that way on your corporate website or elsewhere. This could cause confusion.

- Avoid false urgency - many consumers have been taught that false urgency is a common thread in phishing and other scams. In addition, making an email sound urgent may have more severe consequences, depending on any industry regulations your company adheres to.

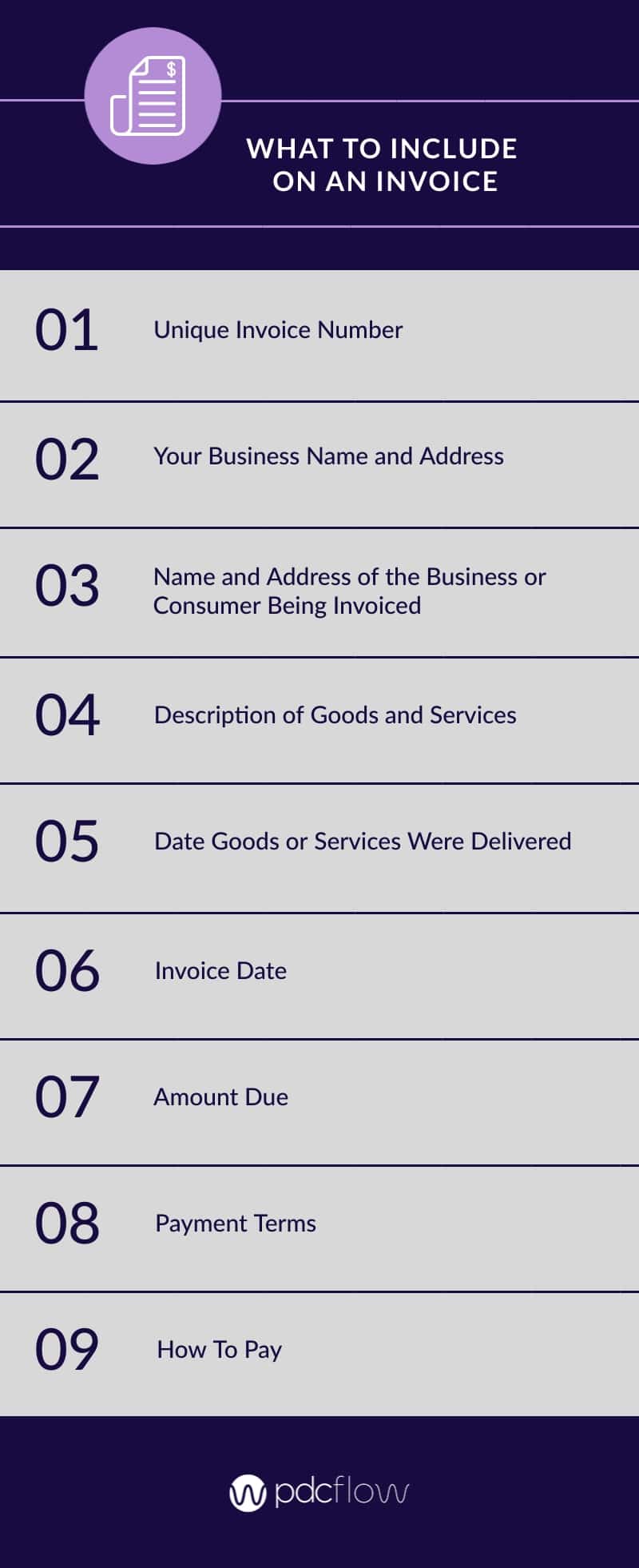

COMPLETE INVOICES

When sending your invoice, be sure to include all of the elements a customer may potentially need to know:

- Account number

- Line items as needed

- Total amount due

- Payment due date

- Consumer name

- Company name

Final Thoughts on Adding Payment Request Emails

Most companies aren’t ready to abandon the channels they’ve used for so many years–and that’s okay!

Adding email payment requests to an existing billing and payment model is an excellent way to enhance current practices, fill in gaps in your procedures and speed up revenue cycles.

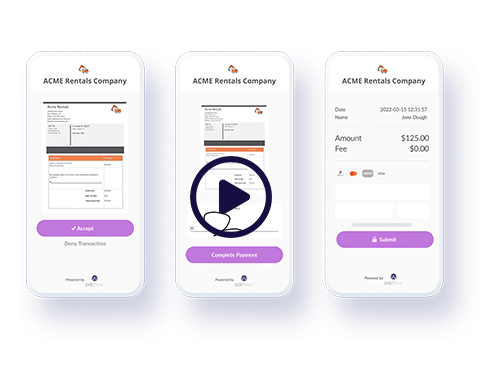

PDCflow’s Flow Technology helps businesses send documents and request signatures, payments, and photo uploads to customers by email or SMS text message. Flow lets you verify recipient identity, track the status of sent messages and more.

To get more information about Flow Technology and how you can use email to send payment requests, set up a short call with one of our payment communication experts.