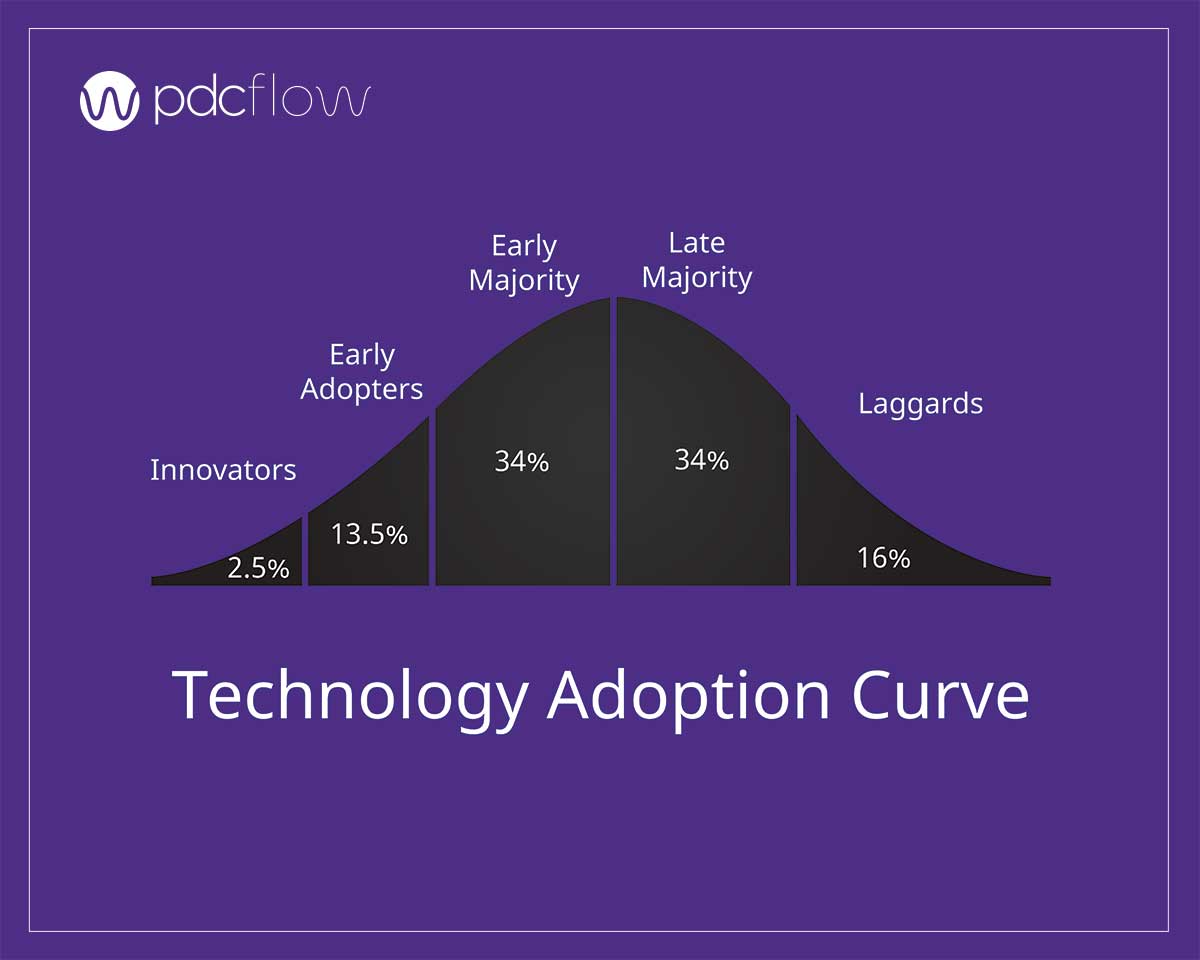

Email and text messages have now been around for decades. Even the laggards of the technology curve use digital tools for work, personal conversations and to communicate with companies. Every company uses these technologies too – but could you be using them more effectively to enhance your workflow management and communications with consumers?

PDCflow’s FLOW Technology can help you cater to the majority of customers who now expect digital communication services to sign documents, receive billing statements and payment reminders and pay their bills.

What is a FLOW?

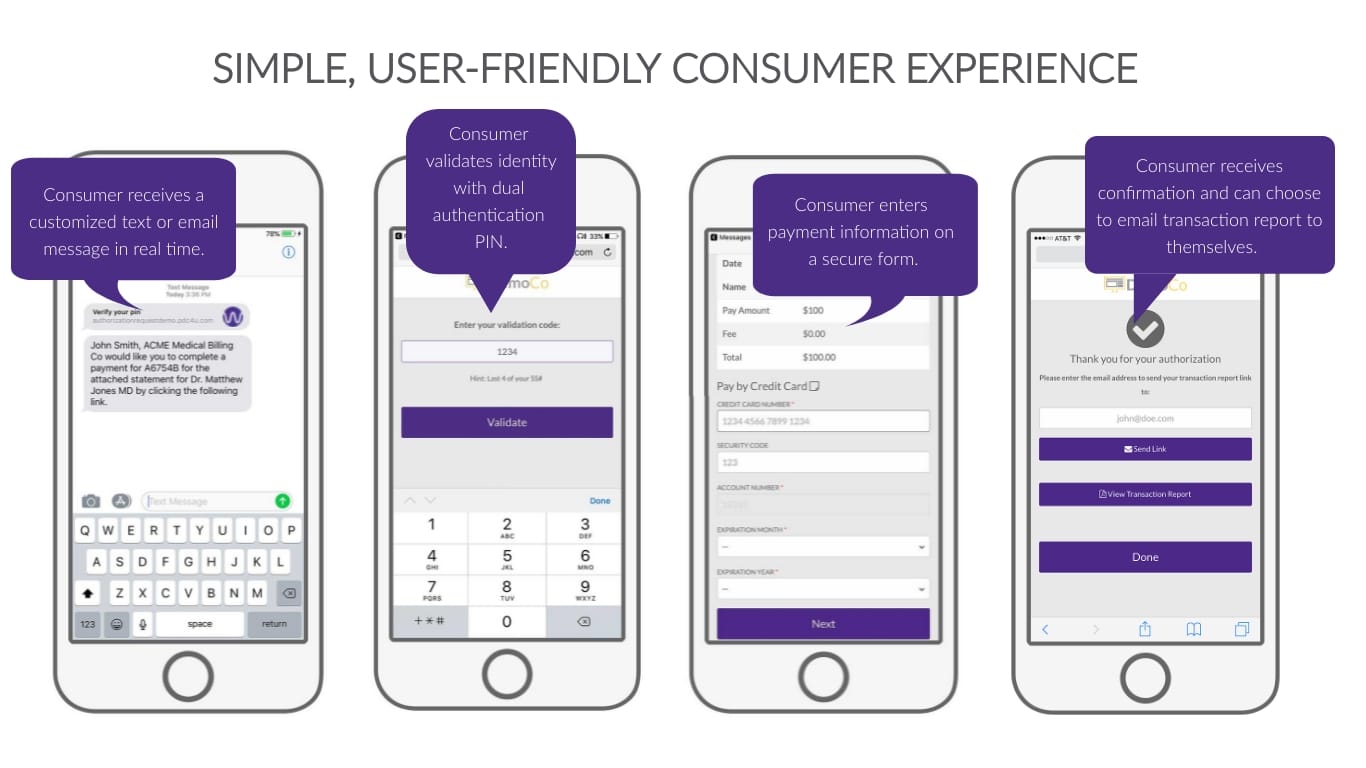

A FLOW is a flexible communication tool that lets you reach out to your customers through the channels they prefer – email and text message. You can use unlimited templates to build out workflows for any scenario your business may encounter.

Complete one task or several in a single workflow: send documents, request photos, capture an eSignature or request a payment.

This makes it easy for consumers to pay bills and interact with your company more quickly. Easier, more convenient end-user experiences lead to simplified office processes for your team.

Simplified Workflow Management

Faster Payment Collection

Enhanced Security and Compliance

No matter what type of business you run, taking digital payments from customers opens your company to certain rules and regulations. When sending a payment request, FLOW works with PDCflow’s payment processing features to offer enhanced data security that reduces your risk and makes transactions safer for consumers.

- PCI compliance - Payment Compliance Industry Data Security Standards (PCI DSS) dictate security measures companies must follow when taking credit card payments. FLOW allows you to accept payments without the need for staff to see or key in payment data, reducing your PCI compliance scope to save your office time and money.

- Nacha compliance - Any company that accepts ACH payments must adhere to Nacha rules – including a recent update requiring WEB transaction account verification before running transactions. When consumers enter their bank account information into a payment form through FLOW, our bank account verification system, ACH Verify, helps you follow Nacha guidelines. ACH Verify validates new account numbers in real-time to reduce fraud and stop potential failed payments before they are submitted for processing.

- Regulation E - Regulation E is part of the Electronic Funds Transfer Act. Parts of this regulation apply to any business that uses Electronic Funds Transfers (EFTs) to take payments. As part of this regulation, recurring payments must be authorized by consumers prior to payments being processed. Using FLOW to request an authorization signature gets payment plans up and running faster while complying with Regulation E.

Who Can Use FLOW?

Debt Collection

Medical Billing

Extended Business Offices

If you run an extended business office, your clients are counting on you to capture early out payments before they become seriously delinquent. EBO payment collections often fail because consumers are concerned about fraud, believe the bill amount isn’t correct or are expected to navigate confusing payment portals.

Through FLOW, you can send a payment request along with billing details directly to a consumer’s mobile phone or email. This legitimizes your collection efforts, gives consumers the information they need while the bill is top of mind, and makes it as simple as possible to follow through with payment.

How to Send a FLOW

Not only are FLOWs easy for your customers to use, they’re also simple to send. Here’s how to send a FLOW to a consumer.

Step 1: Login to your Flow account

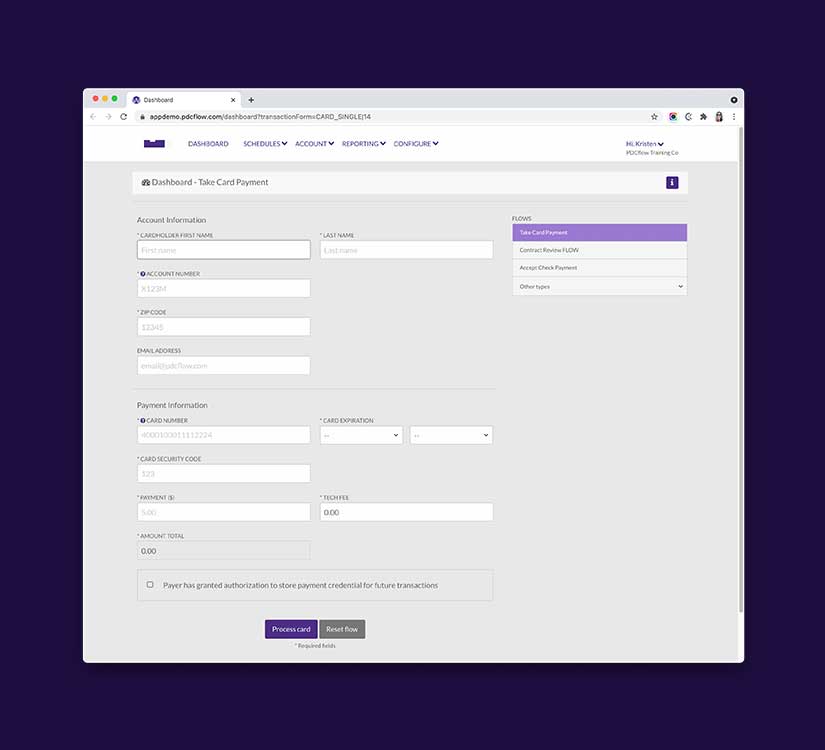

Step 2: Select a FLOW type

Step 3: Enter the needed information into the FLOW’s offered fields

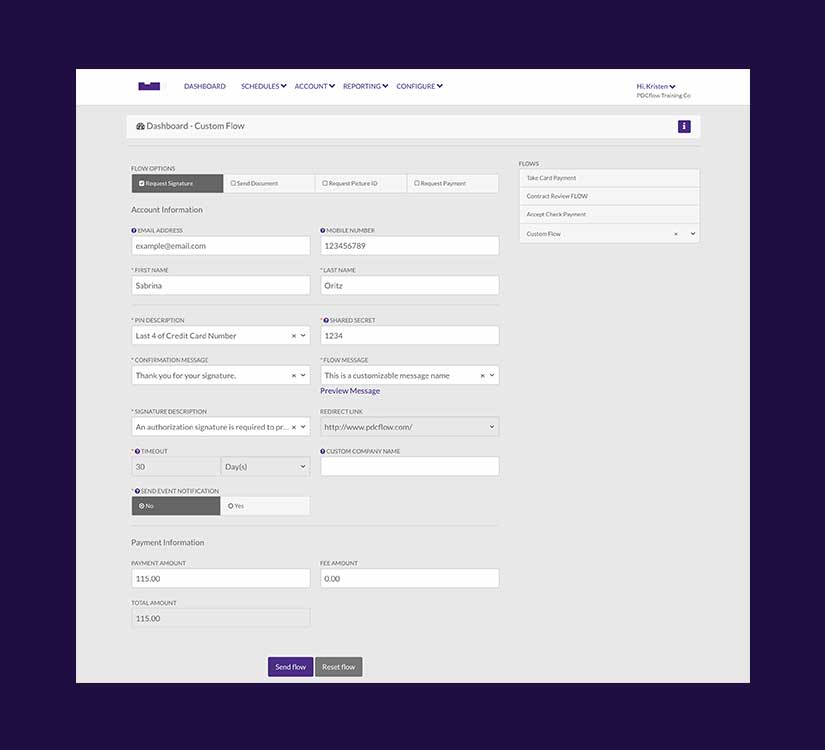

FLOWs are completely configurable. Here are the 3 most popular types of FLOWs:

- Take a Card Payment: Enter payer information and process the payment

- Request Signature Request: Enter your customer’s contact information, a shared security PIN, and send the FLOW to your customer to complete

- Request Payment: Enter your customer’s contact information, a shared security PIN, payment amount due, and send the FLOW to your customer to complete

Step 4: Send more FLOWs

After your FLOW has been created and saved, you will be prompted with multiple options. You may create a new FLOW of the same configuration, create a new FLOW with different configuration options, or even create a payment schedule.

You're done!

Remember, you can create FLOWs with any customization options that suit your business workflows.

- Take a Card Payment: enter payer information and processes a credit card payment

- Take a Check Payment: Enter payer information and process an ACH payment

- Request Signature: send a simple agreement for a customer to sign

- Send Documents: send contracts and agreements for customer to review and sign

- Request Picture ID: request and gather IDs or other documents and images from your contacts

- Request Payment: send payment requests via email and text and gather credit card and ACH payments from your customers

For more information on how you can use FLOW Technology to streamline your business and better serve your customers, speak to a PDCflow account executive today.