Legal professionals for the ARM industry, like Leslie Bender and Joann Needleman of Clark Hill Law, have been addressing Regulation F implementation challenges since the rule was proposed.

Since then, they have continued to be a guiding voice for debt collectors throughout the debt collection rulemaking process. Recently, they sat down with PDCflow’s Sales & Marketing Manager Dawn Updike to discuss one of the most asked about portions of the rule – the Debt Validation Notice.

About the Regulation F Model Validation Notice

The first point Bender and Needleman want all agencies to understand? This document is intended to be a notice or form, NOT a letter.

Keeping this distinction in mind can help you to better understand the expectations and requirements of the document and better adhere to compliance. The notice should include a few key elements:

- Confirming that you’re handling the debt

- Stating the amount that is owed as of a particular date

- Notify consumers about their rights to dispute or complain

- Provide direction to consumers on how to contact the debt collector or access the debt collector’s contactless website or portal

Supplementary information about your business or creditor clients may not always fit into the Model Form B - 1 validation notice. In these cases, you may need to provide these items online or via an alternative method.

If you want to avail yourself of the “safe harbor” for the model validation notice, you would not include any of the supplemental information in your B-1 Model Form validation notice.

What Must the Validation Notice Accomplish?

Regulation F is the CFPB’s well-researched way of interpreting the Fair Debt Collection Practices Act to meet the objective of assuring in debt collection we are attempting to collect the right amount from the right consumer, per that consumer’s communication preferences.

The section of the rule regarding the debt validation notice covers many topics. A few of note are:

- Outlines validation notice requirements

- Provides definitions and explains the purpose of the notice requirements

- Establishes that validation information be clear and conspicuous, and offers safe harbors when using the Model Form B-1 (or something substantially similar)

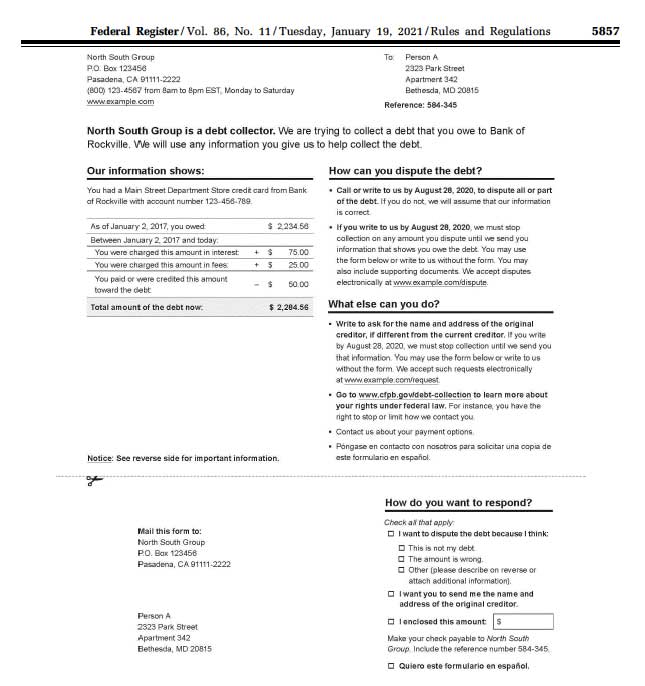

Reg F Model Validation Notice Sample

Itemization Date Disclosures

This is one area that agencies should not wait to address, as it may mean development work on your software, changing in-office processes or closer collaboration with clients.

How you determine itemization dates is an internal decision and may differ from creditor to creditor and the types of debt you collect. The reason you chose a method of date calculation does not need to be explained in your notice but the date itself must be provided.

You may however want to develop a policy and possibly also client-specific work instructions (that going forward you would develop when onboarding new business) explaining which itemization date you have selected per creditor. Itemization date can be calculated one of five ways:

- Last statement date - the date the creditor sent a last invoice or statement to the consumer

- Charge off date - the date the creditor “charged off” a debt

- Last payment date - when the last payment was applied to an account

- Transaction date - the date a good or service was provided by the creditor

- Judgment date - date of a court judgment

Why is it important?

The new process will impact many of your employees and suggests a greater need for communication with original creditors, as they may need to furnish information to help you calculate this date. You’ll also want to harmonize your training and call listening programs to reinforce Reg F topics.

These new definitions for the itemization date were chosen by the CFPB as some of the easiest dates an agency may be able to access that also help consumers identify the debt in question. The CFPB conducted focus groups with consumers to test its theories and approaches.

The new list of ways to calculate the itemization date helps to fulfill the central goals of Regulation F by creating a standard process for all collectors to follow and making it easier for consumers to know what they owe and that they are paying the right amount to the right source.

Calculating End Dates

The end date you supply to consumers must be at a minimum 30 days plus five (5) business days from the date you actually send the notice. It is important to emphasize: this is calculated from the date the notice is sent, even if it was received by the consumer on a different date.

Bender and Needleman say it is up to state law and the underlying contract or agreements creating the consumers’ debts to determine whether you will be charging post-itemization interest and the method you use to do so. You may also choose to place the itemization on a separate page of the Debt Validation Notice as long as it is clear on the first page that you have done so.

Model Validation Notice Safe Harbor

The final rule only provides safe harbor if you use Model B-1 as it is intended (meaning, you are using the form and layout provided). The more your agency strays from this model, the less likely it is to provide you with a safe harbor. Experts expect the CFPB to issue further guidance on some of these validation notice topics.

The CFPB has also emphasized that if other things are included with the Model Form B-1 that overshadow, conflict with, or confuse the consumer, the safe harbor for the Model Form B-1 can be jeopardized. Some more items of note about the model validation notice safe harbor:

- This form must be supplemented to adhere to the state laws wherever and whenever they apply. It does not provide state safe harbors. Confer with counsel to read and interpret state disclosure laws carefully to verify whether or not they specify where in a validation notice they must be placed.

- Straying from the model creates areas of opportunity for the plaintiff’s counsels to challenge your changes. Expect challenges to the term “substantially similar.”

- Optional disclosures add flexibility and greater opportunities for electronic communications.

State Disclosures

State law disclosure placements have raised many questions from agencies. State disclosures must be placed on the back of the notice.

However, there are some disclosures that are required by law to be on the front of the notice. Bender says that this is a rare circumstance and should only be done when a specific provision of law requires the disclosure’s placement on the face or at the top of the validation notice.

Formatting of your state disclosures is also important. You must be sure that all necessary disclosures are printed above the tear off portion of the notice, so consumers may keep this information intact after removing the tear off.

Remember, there are a wide range of views among industry legal experts on whether to only send a consumer the disclosures you reasonably believe apply to that consumer versus sending all possible state or city disclosures.

Again this is a key area to confer with legal counsel familiar with your business and the geographic locations of consumers from whom you attempt to collect.

Dispute Disclosures

The CFPB now requires an actual end date for the debt validation window. To find this, start with the date you will be sending your debt validation notice (including any days it may take you to sort mail or similar) and calculate from there. Some agencies are adding extra days to this time period for consumers to dispute the debt to ensure they account for holidays and weekends within their calculation.

Debt collectors have raised concerns about including a website address and collecting disputes online but adding your web address or a customized QR code to the notice creates the opportunity to collect detailed information about the dispute that will make resolution easier.

Sending people online also drives consumers to your payment portal and gives instant access to online tools that collect consents, ask consumers to update their contact details and give you other information that may help assure you are communicating with consumers in the methods they prefer and that you are attempting to collect from the right person.

Final Guidance

Remember, your agency does have the option to use your own style of debt validation notice if you do not want to take advantage of the safe harbor the B-1 model form offers. That validation notice will have to be reviewed against the Reg F interpretations of what must be in a validation notice.

Also consider this: if and as more debt collectors adopt the Model Form B-1 validation notice – is it risky for your letters to look differently from the model notice – thus potentially increasing the likelihood of being challenged legally by consumer attorneys on some basis?

In the end, every business is different. Understanding your company’s needs and considerations is the first step. Retaining attorneys that can help you look critically at your materials and processes is an essential part of the compliance process.

Once you have created your agency's Regulation F to-do list, find out what vendors are doing to help you prepare too. Some, like PDCflow, already offer useful compliance features you can take advantage of right now.

Keep up to date with compliance and digital payment strategies that can improve your consumer experience and create a better cash flow for your business. Subscribe for weekly updates or for our monthly newsletter.